Naturally,Apple's stock (APPL) has been one of the best-performing stocks in the past 10 years. It's natural that people are looking to buy Apple shares in the UK after the company's latest earnings. I don't blame them at all.

Investing in Apple is more than just acquiring a piece of a company; it's about being part of a legacy that continues to shape the future. With a track record of delivering groundbreaking products and a steadfast commitment to innovation, Apple's stock is a coveted asset for any investor looking to diversify their portfolio with a touch of Silicon Valley genius.

Buying the Apple stock is surprisingly straightforward, and I'm here to guide you through every step of the process. Whether you're a seasoned investor or taking your first dive into the stock market, you'll find that buying Apple shares can be a rewarding addition to your investment strategy. Let's embark on this exciting journey together, and I'll show you how simple it can be to become a part of the Apple success story in just a few easy steps

Quick Guide - How to Buy Apple Shares in the UK

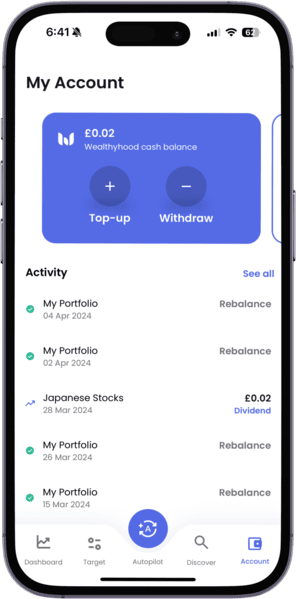

Step 1: Download the Wealthyhood app.

Step 2: Signup for a free account

Step 3: Complete the W-8BEN Form

Step 4: Top-Up your account

Step 5: Select the Apple Stock

Step 6: Specify the amount of Amazon shares you would like to buy

Step 7: Hit "Buy" and then submit your order

And that's it. Investing in Apple is as simple as following the 6 steps presented above.

Buy Apple SharesHow to Invest in Apple by Buying the Apple (APPL) Stock?

I've previously discussed on Wealthyhood's blog how to buy shares in Netflix and Amazon, so if you've read these guides you should be well-equipped with the basics of purchasing stocks in the UK.

Venturing into Apple shares involves a journey not unlike that with Amazon, requiring diligent research and a thoughtful approach. Investing in any entity warrants a serious demeanor, as it comes with its share of risks, including the potential for a permanent capital loss.

Let's navigate through the steps to initiate your investment in Apple with the assistance of an investing app.

1. Explore Investment Platforms and Apps

Before diving into the stock market, it's essential to select an investment platform or app that aligns with your financial goals and investment style. The UK market offers a wide array of options, including robo-advisors, micro-investing apps, and platforms tailored for long-term investors. For those focused on building their portfolio through strategies like dollar-cost averaging, platforms offering low or no commission fees are particularly attractive.

Why Consider Wealthyhood: Wealthyhood is designed with the long-term investor in mind, offering tools to help users strategically grow their portfolios over time without the burden of commission fees. This platform stands out for its user-friendly interface and comprehensive investment tools, making it a viable option for those looking to buy Apple shares with a long-term perspective.

2. Handling U.K. Tax Requirements

Completing the W-8BEN Form: For non-U.S. residents looking to invest in U.S. stocks, such as Apple, completing the W-8BEN form is a critical step. This form is crucial for declaring your foreign status and claiming benefits under tax treaties between your home country and the U.S., potentially reducing the withholding tax on your investment income. Platforms like Wealthyhood simplify this process by integrating the completion of the W-8BEN form into their onboarding process, ensuring a smooth transition for international investors into the U.S. market.

By understanding and navigating these initial steps, investors can position themselves to successfully buy Apple shares, leveraging the potential growth opportunities this global tech giant offers while ensuring compliance with necessary tax laws.

3. Top Up Your Account

Prior to purchasing Apple shares, it's essential to fund your account with your intended investment amount. Simply access the "Account" section within the Wealthyhood app and opt for "Top Up", where you'll specify the sum to be added.

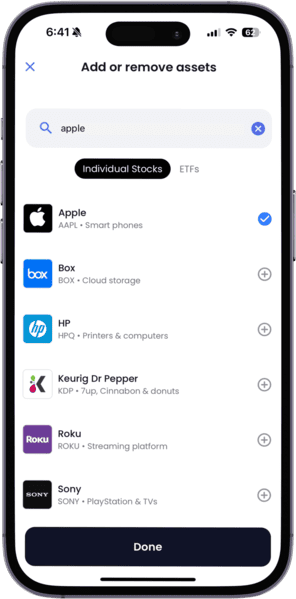

4. Select The Apple Stock

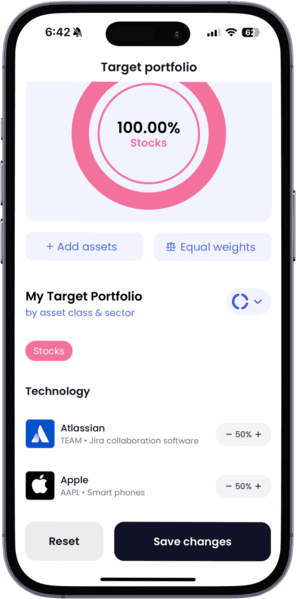

With your account funded, revisit the "Target" portfolio section to define your portfolio's structure. Input Apple in the search field and choose Apple for inclusion in your portfolio. While focusing solely on Apple shares is an option, diversifying with additional stocks could mitigate risk.

5. Construct Your Portfolio

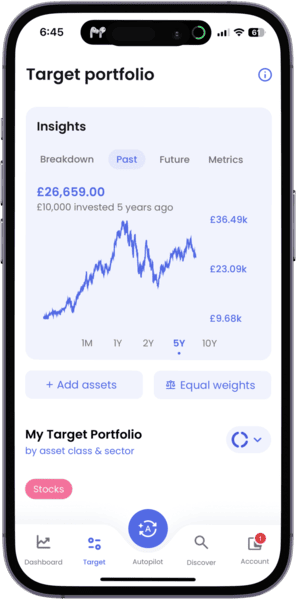

This step is about tailoring a portfolio that resonates with your investment horizon and risk appetite through diversification. It involves a balanced mix of stocks, bonds, real estate, and other assets. Regular portfolio reviews and rebalancing are crucial to remain aligned with your financial objectives. Once you have specified your target portfolio with the amount of Apple shares you want, just hit "Buy Portfolio" and you will submit your order.

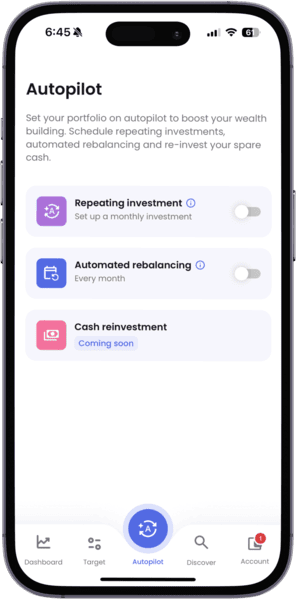

6. Initiate a Recurring Monthly Investment

Adopting a monthly investment routine is a strategic move to compound your wealth over time, irrespective of market fluctuations. This dollar-cost averaging technique entails consistent monthly contributions to your portfolio, fostering investment discipline while cushioning against volatility.

7. Monitor Your Apple Investment

Portfolio oversight is a continuous task, necessitating periodic assessment of your investment's performance and necessary adjustments to stay in tune with your financial aspirations and the evolving market landscape. Adjustments may include portfolio rebalancing, reinvesting dividends, or revising your investment strategy to accommodate life changes.

8. Manage Your Tax Obligations

For UK investors, annual tax reporting is imperative, encompassing accurate disclosure of investment income and capital gains to HM Revenue and Customs (HMRC). Familiarity with your tax allowances, like the Capital Gains Tax and Dividend Allowance, is essential for tax-efficient investing. Leveraging tax-advantaged accounts such as ISAs and pensions can significantly diminish your tax burden, enhancing your investment growth. Keeping abreast of tax legislation and consulting with tax professionals can ensure adherence and financial optimization.

Buy Apple SharesPlease remember, investing is fraught with risks. I am not a financial advisor; this guide is a compilation of my research and personal experiences. I encourage you to conduct your due diligence prior to investing in any stock. For a deeper understanding of stock market investing strategies and processes, consider exploring our guide on stock market investment. Should you wish to delve further into stock market discussions, feel free to contact me at george@wealthyhood.com or connect via LinkedIn.

Apple Company Updates and News for Q1 2024

Profit and Revenue Beat:

Apple surpassed Wall Street estimates for its fiscal first-quarter earnings.

China Revenue Miss:

Sales in China were lower than expected, with a 13% year-over-year decline, causing a post-earnings stock dip.

Vision Pro Launch:

Discussion on the upcoming release of Apple Vision Pro, involving 5,000 patents.

AI Developments:

CEO Tim Cook hinted at significant AI announcements planned for later in the year.

Revenue Details:

Total revenue was $119.58 billion versus the $117.97 billion estimate.

iPhone revenue stood at $69.7 billion, outpacing the $68.55 billion estimate.

Services revenue was reported at $23.12 billion, slightly below the $23.37 billion expectation.

How to Invest in Apple?

Investing in Apple Inc. (AAPL), one of the world's leading technology companies known for its innovative products and strong brand loyalty, requires a nuanced approach. This article aims to guide potential investors through the process, highlighting key factors to consider before downloading an investing app and buying Apple stock or making any investment decision.

Understanding Apple's Business Model

Innovation and Product Ecosystem: Apple's success is largely attributed to its continuous innovation and the ecosystem it has built around its products, including iPhones, iPads, Macs, and services like Apple Music and iCloud. Investors should assess Apple's product pipeline and its potential to retain and attract new customers.

Services Growth: The services segment has become increasingly important for Apple, offering higher margins than hardware sales. This includes everything from the App Store to Apple TV+. Investors should look for growth in this area as it diversifies Apple's revenue streams.

Supply Chain and Manufacturing: Apple's global supply chain is both a strength and a vulnerability, as seen during disruptions caused by events like the COVID-19 pandemic. Understanding how Apple manages its supply chain can give insights into potential risks and efficiencies.

Financial Health

Revenue and Profit Margins: Review Apple's quarterly and annual financial reports to evaluate its revenue growth, profit margins, and earnings per share (EPS). Consistent growth in these areas can be a positive sign for investors.

Balance Sheet Strength: Apple's balance sheet gives a snapshot of its financial health, including liquidity, debt levels, and cash reserves. A strong balance sheet enables Apple to invest in new products, buy back shares, and pay dividends.

Dividends and Share Buybacks: Apple has been returning value to shareholders through dividends and share buybacks. These activities can indicate the company's confidence in its future cash flows and profitability.

Market Position and Competitive Landscape

Market Share: Understanding Apple's position in the markets it operates, such as smartphones and personal computers, can provide insights into its competitive advantage and growth prospects.

Competition: Keeping an eye on the competitive landscape, including emerging threats from other tech giants or innovative startups, is crucial. Apple's ability to maintain its market share and brand value in a competitive environment speaks to its resilience and strategic vision.

External Factors

Regulatory Environment: Apple operates globally, subject to various regulatory landscapes. Regulatory challenges or changes, particularly in key markets like the U.S., Europe, and China, can impact its business operations and profitability.

Economic Conditions: Macro-economic factors, including consumer spending habits and economic downturns, can affect Apple's performance. Investors should consider the broader economic environment when investing in Apple.

Making the Investment

Direct Stock Purchase: Investors can buy Apple shares directly through a brokerage account. It's important to consider the timing of the purchase, as stock prices fluctuate due to market conditions and company performance.

ETFs and Mutual Funds: For those seeking diversification, investing in ETFs or mutual funds that hold Apple stock can be a viable option. This approach spreads the risk across multiple companies while still gaining exposure to Apple.

Continuous Monitoring: Investing in Apple, like any stock, requires ongoing monitoring of the company's performance, market trends, and external factors that could affect its stock price.

Should you Buy Apple Shares in 2024?

As we move through 2024, the question of whether to invest in Apple (AAPL) remains nuanced, with a diverse range of opinions from analysts and market experts. Here's a breakdown of key perspectives and data points to consider, reflecting the complexity of the investment landscape for Apple in 2024. This is not investment advice but rather an overview of current analyst sentiment and considerations for potential Apple investors.

Analyst Ratings and Forecasts

Moderate Buy Consensus:

The consensus among analysts suggests a "Moderate Buy" rating for Apple, with a price target indicating a potential upside of over 20% from current levels. Specifically, the average analyst price target stands at $204.23, which implies a significant upside potential

Diverse Opinions:

Despite a general moderate buy consensus, some analysts have turned bearish on Apple, citing concerns over an extended slowdown in iPhone sales, particularly in the Chinese market. This market is crucial for Apple and has shown signs of struggle against domestic competitors.

Revenue and Earnings Growth:

One of my favourite analysts is forecasting Apple's revenue and earnings over the next few years suggesting moderate growth. The average revenue forecast for 2024 is approximately $385.5 billion, with earnings per share expected to rise incrementally over the next three years.

Potential Catalysts and Challenges

iPhone 15 Expectations:

According to Nasdaq, some market watchers, like Wedbush analyst Dan Ives, are optimistic about Apple's prospects in 2024, especially with the iPhone 15 upgrade cycle. Ives highlights a strong holiday season leading into 2024 and dismisses the concerns about Apple's performance in China as exaggerated.

Game-Changing Catalysts:

Looking ahead, two significant catalysts could potentially influence Apple's stock performance: the adoption of AI features in iPhones and the market reception of the Vision Pro mixed-reality headset. The integration of AI-driven features in iOS could bolster a stronger multi-year iPhone upgrade cycle. However, the Vision Pro headset's high price point and uncertain market demand pose risks.

Market Sentiment and Investment Considerations

Bullish Versus Bearish Views:

The investment community presents a mixed outlook for Apple in 2024. Some express confidence in Apple's innovation pipeline and its ability to navigate market challenges in China, while others advise caution due to the competitive pressures and the high expectations already priced into the stock.

Investment Strategy:

For those holding Apple shares or considering an investment, it's crucial to weigh both the bullish and bearish arguments. Consideration should be given to Apple's potential for innovation and market expansion against the backdrop of competitive and economic uncertainties.

Does Apple Pay Dividends?

Yes, Apple does pay dividends.

As of 2024, Apple has an annual dividend rate of $0.96 per share, distributed quarterly. The most recent quarterly dividend amount was $0.24 per share, with the last ex-dividend date being February 9, 2024. This represents a forward dividend yield of approximately 0.57%. It's important to note that Apple's dividend has shown growth over the years, indicating the company's commitment to returning value to its shareholders through regular dividend payments (Stock Analysis) (Nasdaq).

APPL Apple Stock Long Term Forecasting

Forecasting the future performance of a stock like Apple's (AAPL) involves examining several key factors, including market trends, company innovation, competitive landscape, and broader economic indicators. While specific stock price predictions can be challenging and highly speculative, we can consider potential directions based on current trajectories and strategic initiatives. This analysis is not financial advice but rather a speculative exploration based on current trends and industry dynamics.

2-Year Outlook

In the short-to-medium term (2 years), Apple is likely to continue capitalizing on its strong brand, loyal customer base, and innovative product pipeline. With the ongoing expansion into services like Apple TV+, Apple Music, and the potential growth of the Apple Car project, revenue diversification could support stock stability and growth. Assuming continued innovation and market expansion, Apple's stock could see modest growth, tempered by the competitive pressures and regulatory challenges that come with being a tech giant.

5-Year Outlook

Over a 5-year horizon, the impact of Apple's investments in research and development, particularly in areas like augmented reality, wearables, and health technologies, could become more pronounced. As the digital and physical worlds continue to merge, Apple's efforts to secure a leading position in this transition could pay off, potentially resulting in significant stock appreciation. Additionally, the global push towards green technologies and Apple's commitment to carbon neutrality could enhance its market appeal, particularly among ESG (Environmental, Social, and Governance) investors.

10-Year Outlook

Looking a decade ahead, the landscape becomes even more speculative. However, Apple's track record of disrupting industries—from personal computing and smartphones to music and potentially automotive—suggests a capacity for long-term value creation. If Apple successfully navigates the challenges of market saturation in its core product lines and continues to innovate or disrupt new markets, its stock could see substantial growth. The evolution of technology and consumer preferences, alongside Apple's responses to these changes, will be critical.

Considerations

Regulatory Challenges:

Increasing scrutiny from regulators around the world could impact Apple's operations and financials.

Competition:

Intensifying competition in all segments, particularly from companies in Asia, could pressure Apple's market share and margins.

Technological Advancements:

Apple's ability to stay at the forefront of technological innovation is crucial. Missed opportunities in emerging technologies could impede growth.

Global Economy:

Macroeconomic factors, including trade relations, currency fluctuations, and economic cycles, will influence Apple's performance.

F.A.Q.s

Who owns the most shares in Apple?

The largest shareholder in Apple is often an institutional investor, such as Vanguard Group or Berkshire Hathaway. Major shareholders include a mix of institutional investors, mutual funds, and key executives within the company, with the exact figures fluctuating over time.

Why are Apple Dividends so low?

Apple's dividends are perceived as low because the company focuses on reinvesting its profits into research, development, and expansion to drive future growth. This strategy supports innovation and market expansion, aiming for long-term value rather than short-term dividend yield.

Is Apple worth investing in long-term?

Many investors consider Apple a solid long-term investment due to its strong financial health, innovative product pipeline, and significant market presence. However, as with any investment, it's important to conduct thorough research and consider your financial goals and risk tolerance.

How to invest in Apple and earn money?

To invest in Apple and potentially earn money, you can buy Apple shares in the UK through a brokerage account. Consider a diversified approach, including long-term holding and possibly reinvesting dividends, to capitalize on the company's growth potential.

What if you bought $1000 shares of Apple in 1997?

If you had invested $1,000 in Apple shares in 1997, your investment would have grown exponentially, thanks to multiple stock splits and the company's significant growth in value. The exact amount would depend on the specific timing of your purchase and any reinvestment of dividends.

How to earn $500 a month from Apple stock?

Earning $500 a month from Apple stock would require a substantial investment, given the current dividend yield. Calculate based on the annual dividend rate and the amount of money you would need to invest to generate $6,000 yearly in dividends. This scenario emphasizes a long-term, high-volume investment strategy.

Wrap Up

In conclusion, investing in Apple shares in the UK offers a strategic opportunity for alignment with the tech giant's innovative path and solid market presence. Despite market fluctuations, Apple's resilience and growth trajectory signal a promising investment for those seeking long-term value. However, investors must conduct their own research and due diligence, considering market trends and Apple's future projects, to make informed decisions and potentially secure significant returns from this leading global company.

Capital at risk. This article is for information purposes only and is not investment advice nor a recommendation. You should consider your own personal circumstances when making investment decisions. Past performance is not a reliable indicator of future performance. Tax treatment depends on your personal circumstances and rules can change.