If you're thinking about investing in stocks, we've got a simple step-by-step guide for you.

In this article, you'll learn how the UK stock market works, how and where to buy shares in UK and what fees are charged. Moreover, we will give you advice on how to manage fees, how to decide which shares to buy, how to calculate your taxes as well as the risks associated with investing in shares.

So, whether you're new to investing or looking for a straightforward platform, our guide will help you easily navigate the process and create a diversified asset protector to suit your needs.

BTW here is a quick step-by-step list of how to invest in stocks:

Understand how the stock market works

Find where you can buy stocks

Decide what platform to use

Decide on an investing strategy

Understand the risks

Calculate taxes

Buy and sell stocks through the platform of your choice

But now let’s dive a little deeper into a detailed guide that every UK beginner investor who is interested in stocks should read.

How the UK Stock Market Works?

As Stergios discussed in our previous articles stocks represent partial ownership of a company. The UK Stock Market is a marketplace where investors buy and sell shares and stocks of publicly listed companies. Here is what you need to know for a better understanding of how the UK stock market works.

Listed Companies – First, companies decide to go public by listing their shares on the stock market. This means they're offering a portion of ownership to the public.

Buying Shares – Investors, including individuals and institutions, can buy these shares. When you own shares, you become a shareholder, entitled to a portion of the company's profits and a say in major decisions through voting at shareholder meetings.

Stock Exchanges – In the UK, the primary stock exchange is the London Stock Exchange (LSE). Other smaller exchanges exist, too. The LSE is where most large companies are listed.

Stock Prices – The price of a stock is determined by supply and demand. If more people want to buy a stock (demand) than sell it (supply), the price increases, and vice versa.

Indices – The performance of the stock market is often measured by indices like the FTSE 100, which tracks the 100 largest companies on the LSE. It gives an overview of how well the overall market is doing.

Market Participants – Besides individual investors, there are professional participants like brokers, who facilitate buying and selling, and market makers, who ensure liquidity by buying and selling stocks.

Remember, investing requires patience and a long-term perspective. Before you start, take the time to research companies, understand their financial health, and consider market trends. Many investors use analysts' reports, financial news, and company filings for informed decision-making.

Where to Buy Stocks and Shares in UK?

Investing in stocks and shares can be done through various avenues, catering to different preferences and levels of expertise. Here, we explore some common options for individuals looking to enter stock market investments.

Investment Apps & Platforms

For beginners seeking a user-friendly entry into stocks, investment apps and other online platforms offer a convenient solution.

As mentioned in our in-depth guide here is the list of the best investment apps right now that you should consider to buy stocks if you live in UK.

Moneybox

Trading 212

Nutmeg

Interactive Investor

Hargreaves Lansdown

Wealthyhood

AJ Bell Youinvest

Freetrade

e-Toro

You can read our full review of investing apps guide here!

These platforms provide easy-to-use interfaces, educational resources, and access to a diverse range of stocks, making them suitable for those just starting.

Buy Your First StockRobo Advisors

Robo advisors are automated investment platforms that use algorithms to create and manage a diversified portfolio based on your risk tolerance and financial goals. For beginners, robo-advisors simplify the investment process. Top choices for UK newcomers include:

Nutmeg

Moneyfarm

InvestEngine

IG Smart Portfolios

Wealthyhood

Wealthify

Moneybox

These are some excellent choices if you are looking to buy stocks through a robo advisor.

You can read our complete review guide of Robo-Advisors and decide for yourself which one fits you best.

Through a Financial Advisor:

If you prefer personalised guidance, you may choose to buy stocks through a financial advisor. These professionals provide tailored investment advice based on your financial situation and goals. Established financial advisory firms like Charles Schwab and Vanguard offer not only a human touch but also a wealth of financial planning services for beginners venturing into the stock market.

Directly from the Company

For a more hands-on approach, investors can buy stocks directly from the companies themselves. Many companies offer Direct Stock Purchase Plans (DSPPs), allowing individuals to buy shares without going through a broker. This option may appeal to those who want a direct relationship with the companies they invest in. However, keep in mind that not all companies offer this option, and the process can vary.

How to Buy and Sell Stocks

Investing in stocks using an investment platform such as Wealthyhood has become increasingly accessible and user-friendly. These are the common steps to follow when you want to buy and sell stocks.

For this example, we will show you how you can buy stocks and shares easily with the Wealthyhood app. This is a free app that you can use to invest both in stocks and ETFs. All you need to do is to download the Wealthyhood app to your smartphone.

Create an Account – Start by creating an account on Wealthyhood. Provide your personal details and follow the platform's instructions for account verification.

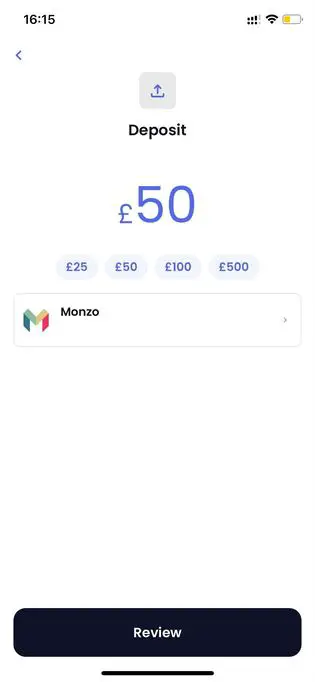

Deposit Funds – Once your account is set up, deposit funds into it. Most platforms allow you to transfer money directly from your bank account. Ensure that you have enough funds to cover your intended investments.

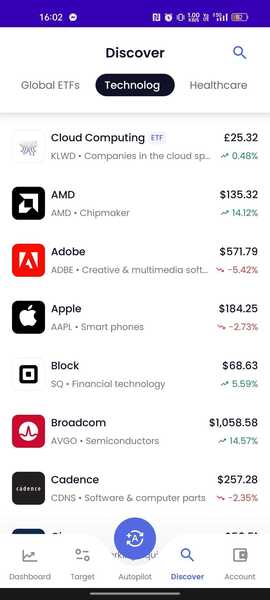

Explore the Platform – Familiarize yourself with the platform's interface. Look for sections like "Trade" or "Invest" where you can buy and sell stocks. Platforms often provide research tools, educational resources, and real-time market data.

Research Stocks – Use the platform's research tools to explore different stocks. Evaluate company profiles, financial performance, and any relevant news. Consider your investment goals and risk tolerance when selecting stocks.

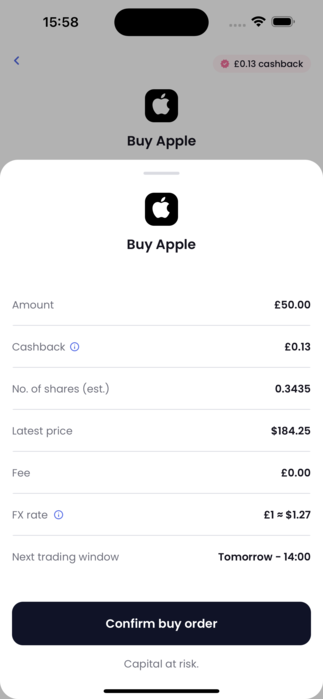

Initiate a Buy Order – When you're ready to buy stocks, go to the discover section of the platform. Select the stock you want to buy and click on it. Specify the number of pounds you’d like to spend and tap confirm buy order.

Your order should be placed now.

Review – Review your buy order details, including the number of shares, the total cost, and any associated fees.

Monitor Your Investment – Keep track of your investments using the platform's portfolio tracker. You can find everything you need on Wealthyhood’s dashboard. Monitor the performance of your stocks, and stay informed about any news or updates related to the companies you've invested in.

Initiate a Sell Order – When you're ready to sell stocks, go to your portfolio. Select the stock you want to sell and click on it. Specify the number of shares and choose any additional order parameters.

Review and Confirm Sell Order – Review the details of your sell order, including the selling price and any fees. Confirm the order, and the platform will execute the sell trade.

Withdraw Funds (Optional) – If you wish to withdraw funds from your investment account, navigate to the withdrawal section. Specify the amount you want to withdraw, and follow the platform's instructions for transferring money back to your bank account.

Buy Your First StockDifferent Ways to Buy Stocks and Shares

Investing in stocks and shares offers various pathways, each suited to different preferences and financial goals. Let's take a closer look at them.

Buy Shares Directly

One straightforward method is to buy shares directly from individual companies. This involves becoming a shareholder by purchasing stocks on the open market. This approach provides a direct connection to the companies you invest in, allowing you to participate in shareholder meetings and potentially receive dividends. However, it requires research and monitoring of individual stocks.

Buy Funds

Investors can also opt for funds as a diversified and managed approach to stock market participation. Funds pool money from multiple investors to invest in a diversified portfolio of stocks. Here are various types of funds you can find –

Exchange-Traded Funds (ETFs) – They are funds that trade on stock exchanges, offering diversification across multiple assets. ETFs often track specific indices, sectors, or commodities, providing a cost-effective way for beginners to achieve broad market exposure.

Open-Ended Investment Companies (OEICs) – These investment funds issue and redeem shares based on investor demand. They typically spread investments across a range of assets and may be actively or passively managed. OEICs provide flexibility and liquidity to investors.

Investment Trusts – They're closed-end funds that issue a fixed number of shares. Similar to individual stocks, they are traded on stock markets and often have a specific investment objective that can be actively managed. Because of their closed structure, they are less influenced by daily investor flows.

Mutual Funds – Mutual funds pool money from investors to invest in a diversified portfolio managed by a professional fund manager. They are open-ended and continuously issue and redeem shares at the current Net Asset Value (NAV). Mutual funds can cover various asset classes and investment strategies.

Fees Charged When Buying Stocks Explained

When buying stocks, investors should be aware of various fees associated with the transaction. Here's an explanation of the common fees involved, along with a range of fees that investors may encounter:

1. Commission Fees – Commission fees are charges imposed by brokers or platforms for executing stock trades on behalf of investors. These fees can vary and may be a fixed amount per trade or a percentage of the transaction value. Commission fees can range from as low as $0 with some commission-free platforms to $10 or more per trade with traditional brokerage firms.

2. Spread Costs – The spread represents the difference between the buying (ask) and selling (bid) prices of a stock. Investors may incur a cost, known as the spread, as they buy a stock at a slightly higher price than the current market value or sell it at a slightly lower price. Spread costs vary depending on market conditions and the liquidity of the stock but are generally a fraction of a percentage point

3. Exchange Fees – Exchanges charge fees for executing trades on their platforms. These fees are typically minimal and contribute to the overall transaction cost. Exchange fees are often a few cents per share, adding a marginal cost to the overall transaction.

4. Regulatory Fees – Regulatory fees are charges imposed by regulatory bodies to fund oversight and enforcement activities. These fees are usually passed on to investors by brokers. Regulatory fees are typically a small fraction of a cent per share traded and may be capped at a specific amount per transaction. You can read more about the regulatory fees on FCA’s official website.

5. Foreign Exchange Fees (for international trades) – If buying stocks listed on foreign exchanges, investors may incur foreign exchange fees when converting their home currency into the currency of the stock's listing. Foreign exchange fees can vary and may include a percentage-based fee or a flat rate per transaction.

Tips for Managing Fees

If investing money in shares or funds will cost you extra, you can still minimise such expenses by following these tips:

Choose Commission-Free Platforms – Consider using commission-free trades to minimise transaction costs.

Use Limit Orders – Use limit orders instead of market orders to control the price at which you buy stocks, potentially reducing the impact of spread costs.

Be Mindful of Broker Policies – Understand the fee structure of your chosen broker, including any additional charges or account maintenance fees.

Consider Long-Term Investing – For long-term investors, the impact of fees can be mitigated by holding onto investments for extended periods, reducing the frequency of transactions.

How to Invest in Stocks for Beginners

Investing as a beginner can be both exciting and daunting. For beginners in the UK looking to step into the world of investing in 2024, the approach should be strategic, informed, and aligned with personal financial goals and risk tolerance. We recently published a super in-depth guide for our beginner investor readers. Here are some key steps from this article summarised.

Understand the Basics: Before diving into investments, it's crucial to understand what investing entails. Unlike saving, investing means putting your money into assets like stocks, bonds, or mutual funds, which are expected to appreciate in value over time. Recognise that investing involves some level of risk, but historically, it has yielded higher returns than traditional savings, especially when considering inflation and tax impacts. Set Clear Investment Goals: Define what you want to achieve with your investments. Goals could range from saving for retirement, buying a home, funding education, or building an emergency fund. Having specific, measurable, achievable, relevant, and time-bound (SMART) goals will guide your investment decisions and help maintain focus during market fluctuations.

Assess Your Risk Tolerance: Understanding your comfort level with risk is essential. Younger investors might be more inclined towards higher-risk, higher-return investments like stocks, while those closer to retirement may prefer safer options like bonds. Your risk tolerance will shape your investment portfolio's composition. Educate Yourself – The foundation of successful investing begins with knowledge. Take the time to understand basic financial concepts, investment strategies, and the dynamics of the stock market to make informed decisions. Explore reputable educational resources, read articles, and consider taking online courses. You can take a look at our learning guides to simply understand investing as a beginner, ETFs, portfolios and more.

Build a Diversified Portfolio – Diversification is a key principle in managing risk. Spreading your investments across different assets can help mitigate the impact of fluctuations in any one investment. Consider a mix of stocks, bonds, and other investment assets. Explore low-cost index funds or ETFs to achieve broad market exposure without relying on individual stock picking.

Start with Small, Regular Investments – Consistency is key in investing. Regular, smaller investments over time, known as dollar-cost averaging, can help reduce the impact of market volatility. Begin with an amount you're comfortable with and commit to regular contributions.

Use Tax-Efficient Accounts – Taking advantage of tax-efficient investment accounts can enhance your returns by minimising tax liabilities on your gains. Explore Individual Savings Accounts (ISAs) and other tax-advantaged accounts available in the UK. These accounts can provide a tax-efficient environment for your investments.

Stay Informed and Stay the Course – Markets can be unpredictable, and short-term fluctuations are normal. Staying informed and maintaining a long-term perspective is essential. Keep up with financial news, but avoid reacting impulsively to market noise. Focus on your investment strategy and remember that successful investing is often about time in the market, not timing the market.

Consider Professional Advice – Seeking advice from financial professionals can provide valuable insights, especially for those new to investing. If unsure, consider consulting with a financial advisor. They can help tailor your investment strategy to your individual circumstances and provide guidance on navigating the complexities of the market.

How to Decide What Stocks to Buy

Stock picking for new investors involves a blend of strategic planning, thorough research, and an understanding of market dynamics. While the potential for high returns exists, it's crucial to be aware of the risks and invest responsibly. Remember, successful investing is not just about selecting the right stocks but also about managing your portfolio wisely to align with your long-term financial objectives.

With that said, here are some things that it’s wise to be studied before buying a company’s stock.

1. Financial Health of the Company

Earnings Per Share (EPS): Measures the company's profitability on a per-share basis. A consistently rising EPS often indicates good health.

Price-to-Earnings (P/E) Ratio: Compares the company's stock price to its EPS. A lower P/E may suggest the stock is undervalued.

Debt-to-Equity Ratio: Assesses the company's financial leverage. A high ratio could indicate higher risk.

2. Market Potential

Industry Trends: Investing in industries with growth potential can be beneficial. Technology and renewable energy are current examples.

Market Capitalization: Reflects the company's size and stability. Large-cap stocks are typically more stable, while small-caps may offer growth potential but with higher risk.

3. Historical Performance

Stock Price History: While past performance is not indicative of future results, a history of steady growth can be a positive sign.

Dividend History: Consistent or increasing dividends over time can be a sign of a company's health and investor-friendly policies.

4. Valuation Metrics

Price-to-Book (P/B) Ratio: Compares the market value to the book value. A lower P/B ratio can indicate undervaluation.

Price-to-Sales (P/S) Ratio: Useful for evaluating companies that may not be profitable yet but have significant sales.

5. Risk Assessment

Risk Tolerance: Consider your comfort with market fluctuations. Higher-risk stocks may offer greater growth potential, but also more volatility.

Diversification: Investing in a range of stocks and sectors can help mitigate risk.

6. External Factors

Economic Indicators: Overall economic health can impact stock performance. Interest rates, inflation, and GDP growth are key indicators.

Geopolitical Events: Global events can have short-term impacts on stock markets.

Strategies for Investing in Stock Market

Each strategy aligns with different financial goals, risk tolerances, and investment horizons. As a beginner, familiarizing yourself with these strategies can help you make informed decisions.

There is no best strategy to pick from but in general simpler strategies that do not require active trading are better for beginner investors who are looking to make their first steps in the stock market.

As Warren Buffett once famously said

"Our favorite holding period is forever."

This quote emphasizes focusing on long-term investments rather than getting swayed by short-term market fluctuations. It aligns with the 'Buy and Hold' strategy which focuses on Long Term Investing. It’s important to note that Buffett was famously a long-term and value investor so there are some things to learn from this legend.

With that said here are some common strategies for stock market investing including Long Term and Value Investing:

Long-Term Investing

Long-term investing involves buying and holding stocks for several years or even decades. The goal is to benefit from compound growth and dividends over time. This strategy often focuses on investing in stable companies with a strong track record of growth and profitability, or in index funds that track the performance of the overall market. It's suitable for investors who are willing to weather short-term market fluctuations for potentially greater long-term returns.

Value Investing

Value investing is based on the idea of finding undervalued stocks that have strong fundamentals. Investors using this strategy look for stocks trading below their intrinsic value, often due to market overreactions. The key is to identify companies with solid financials, including earnings, dividends, and growth potential, but whose stock prices are currently depressed. This strategy requires thorough research and a good understanding of financial metrics to identify these undervalued stocks.

Growth Investing

Growth investing focuses on companies that exhibit signs of above-average growth, even if the share price appears expensive in terms of metrics like price-to-earnings (P/E) ratio. Investors who follow this strategy invest in companies with high potential for future growth, often in sectors like technology, biotech, and renewable energy. The risk is typically higher, as these stocks can be more volatile, but the potential for substantial returns is also higher.

Dividend Investing

Dividend investing involves buying stocks of companies that pay regular dividends. The strategy is to earn a steady income stream from dividends in addition to any long-term capital gains. This approach is often favored by investors who need regular income, such as retirees. It involves identifying companies with a strong history of dividend payouts and financial stability to continue making those payments.

Active vs. Passive Investing

Active investing involves frequent buying and selling of stocks to capitalize on short-term market movements. It requires a significant time investment and skill in market analysis. Passive investing, on the other hand, involves investing in index funds or ETFs that track a market index, requiring less time and often incurring lower fees.

Technical Analysis

Some investors use technical analysis, which involves analyzing statistical trends gathered from trading activity, such as price movement and volume. This strategy is based on the idea that historical trading activity and price changes can be indicators of future market behavior.

Remember, no strategy guarantees success, and it's important to consider your personal financial situation and consult with a financial advisor before making investment decisions. The stock market can be unpredictable, and diversifying your investment portfolio is key to managing risk.

What are the Risks of Investing in Stocks?

Investing in stocks can offer opportunities for wealth accumulation, but it also comes with inherent risks. Here are some common risks associated with investing in stocks.

Market Risk – Also known as systematic risk, refers to the possibility of overall market fluctuations affecting the value of all investments. For example, economic conditions, geopolitical events, and broad market trends can impact stock prices.

Price Volatility – Stock prices can be highly volatile, experiencing rapid and unpredictable changes in value over short periods. In some cases, volatility can lead to significant price swings, potentially resulting in both gains and losses. Investors need to be prepared for the short-term fluctuations in the market.

Company-Specific Risks – Each company faces unique risks related to its industry, management, competition, and internal operations. Factors like poor management decisions, competitive pressures, or industry downturns can adversely affect individual stocks. To avoid such a situation, diversification can help mitigate company-specific risks to some extent.

Liquidity Risk – Liquidity risk arises when there is insufficient market demand for a particular stock, making it challenging to buy or sell shares at desired prices.

Illiquid stocks may experience wider bid-ask spreads, potentially leading to larger transaction costs or difficulty exiting a position quickly.

Interest Rate Risk – Changes in interest rates can impact stock prices. Generally, rising interest rates can lead to lower stock valuations.

As an investor, you can experience declines in the value of your stock holdings when interest rates rise. This risk is particularly relevant for dividend-paying stocks.

Credit Risk – Credit risk is associated with investments in bonds or stocks of companies with high levels of debt. If a company defaults on its debt obligations, it can negatively impact stock prices. For example, credit-related issues may lead to financial distress, bankruptcy, or reduced profitability, affecting shareholder value.

Inflation Risk – Inflation erodes the purchasing power of money over time, impacting the real returns of investments. If the rate of return on investments does not outpace inflation, the real value of the investment may decrease.

Regulatory and Legislative Risks – Changes in laws and regulations can impact the business environment and affect the profitability of companies. New regulations or government policies may lead to increased costs, changes in market dynamics, or restrictions on certain business activities, affecting stock prices.

Psychological and Behavioral Risks – Investor sentiment and behaviour can influence stock prices. Market participants may react emotionally to news or events. Emotional decision-making, such as panic selling during market downturns or excessive optimism during bull markets, can lead to suboptimal investment outcomes.

Currency Risk (for International Investments) – If investing in stocks denominated in foreign currencies, fluctuations in exchange rates can impact returns. Changes in currency values relative to the investor's home currency can influence the overall return on international investments.

What are the Tax Implications When Investing in Stocks?

Investing in stocks in the UK comes with various tax implications, primarily revolving around Capital Gains Tax, Income Tax, and Stamp Duty. Here's an overview of the key aspects of the UK tax system for investors in stocks:

Capital Gains Tax (CGT) – Capital Gains Tax (CGT) is a tax levied on the profit generated from selling assets, such as stocks. The tax is applied to the actual gain realized, not the total sale proceeds. For individuals, CGT rates are 10% for the entire capital gain if the overall annual income is below £50,270. If the annual income surpasses the £50,270 threshold, the CGT rate increases to 20% for the entire capital gain. It's important to note that separate rates apply to residential property transactions.

Annual Exempt Amount – Each individual is entitled to an annual exempt amount. Gains up to this limit are not subject to CGT. The annual exempt amount in 2022/23, the AEA was £12,300 and for 2023/24, it is reduced to £6,000.

Tax-Efficient Accounts – Utilizing tax-efficient accounts, such as Individual Savings Accounts (ISAs) or Self-Invested Personal Pensions (SIPPs), can shield investments from CGT.

ISAs: Investments held within an ISA are exempt from CGT. SIPPs: Capital gains within a SIPP are not subject to CGT.

Stamp Duty Reserve Tax - When you buy UK stocks electronically, you're typically charged Stamp Duty Reserve Tax at 0.5% of the transaction value. This tax is not applied when you sell shares.

Dividend Tax – Dividend income is subject to tax, but there is a Dividend Allowance that allows individuals to receive a certain amount of dividend income tax-free. The Dividend Allowance is £1,000 (6 April 2023 to 5 April 2024). Above this threshold, dividends are taxed at varying rates depending on your overall income.

Tax Bands – The rate of income tax is determined by your overall income, and there are different tax bands with varying rates.

Inheritance Tax: Stocks may be subject to Inheritance Tax if you pass away and leave them to your heirs, depending on the value of your estate and the specifics of your situation.

Tax Reporting and Compliance – UK investors are responsible for reporting their capital gains and income to HM Revenue & Customs (HMRC). Investors may need to complete a self-assessment tax return, especially if they have substantial capital gains or complex financial affairs.

Tax Year and Deadlines – The UK tax year runs from April 6 to April 5. Investors need to be aware of tax deadlines, including the deadline for submitting self-assessment tax returns.

Important Note - Tax laws can change, and it's crucial to stay updated with the latest regulations. For the most current information, it is advisable to consult with a tax professional or refer to HMRC's official guidance.

FAQs

Easiest Way to Buy Shares in the UK

Try WealthyHood. It simplifies the process with a user-friendly interface, providing a straightforward platform for both new and experienced investors. Sign up, research, and start buying shares hassle-free.

Is investing in stocks and shares worth it?

Yes, it can offer long-term wealth growth. While it carries risks, historically, stocks have shown significant returns over the long term. Diversify your portfolio, stay informed, and consider your financial goals for a balanced approach to wealth-building.

Is it Worth Investing £1000?

Yes, start small and gradually increase. Starting with £1000 allows you to dip your toes in the market. Consider it an initial step, and as you gain confidence and experience, you can adjust your investment amounts accordingly.

Best Stocks for Beginners

Consider index funds, ETFs, or well-established companies. For beginners, stable index funds like FTSE 100 or S&P 500 can provide diversified exposure. Established companies with a history of consistent performance also make for good starting points.

How Old Do You Have to Be to Invest in Stocks

In the United Kingdom, the legal age for investing in stocks is 18 years old. This is when an individual is considered a legal adult and can open a brokerage account in their own name. However, for those under 18, there are still opportunities to get involved in the stock market.

Parents or guardians can open a Junior ISA (Individual Savings Account) or a custodial account for their children, where they can manage investments on behalf of the minor. Once the child turns 18, control of these accounts can be transferred to them. This approach allows younger individuals to gain exposure to the stock market under the supervision and guidance of an adult.

Do I Owe Money if the Stock Goes Down?

No, unless using leverage (margin trading). Generally, you won't owe money if a stock goes down unless you're involved in margin trading, where borrowed funds are used. Regular stock ownership doesn't create a debt obligation.

How to Make Money From Stocks?

Through capital gains (selling at a higher price) and dividends (regular payouts from some stocks). Stocks offer two main ways to make money – capital gains through selling at a higher price than bought, and dividends, regular payouts some companies provide to shareholders based on their profits. Regularly review and adjust your portfolio for potential growth.

Conclusion

In wrapping up, the art of investing in stocks is a nuanced and evolving discipline.

It demands more than just a cursory understanding of the market; it requires a deep dive into the principles of investment, a well-thought-out plan for one's financial goals, and a keen sense of one's own risk appetite.

Diversification, patience, and ongoing education are the cornerstones of successful stock investing. As investors embark on this exciting yet challenging journey, they must remember that the stock market's promise of high returns comes with its share of risks and uncertainties. Staying informed, adaptable, and resilient in the face of market fluctuations is key. Ultimately, stock investing is not just a financial venture but a continuous learning experience that offers valuable lessons in both wealth creation and personal growth.

As always thanks for taking the time to read this guide. Readers who have read my content previously know how passionate I am about investing and everything related to economy. If you share that passion with me feel free to connect with me on LinkedIn or send me an email at george@wealthyhood.com to discuss the latest economic news with me. I will be delighted to get to know you.

Capital at risk. This article is for information purposes only and is not investment advice nor a recommendation. You should consider your own personal circumstances when making investment decisions. Past performance is not a reliable indicator of future performance. Tax treatment depends on your personal circumstances and rules can change.