Table of Contents

- How to Invest in Amazon in the UK

- Amazon Company Updates

- Is it a Good Time to Buy Amazon Shares?

- Amazon Stock Forecast and Price Predictions

- How High Can the Amazon Stock Go?

- Amazon Stock Fundamentals

- How to Research the Amazon Stock

- Is Amazon Listed on the UK Stock Exchange?

- Does Amazon Pay Dividends?

- What Are the Costs of Investing in Amazon?

After years of consistent growth, I wouldn't blame you if you are wondering how to buy Amazon shares in the UK.

Investing in Amazon has been a successful way for many investors to grow their wealth over the past 20+ years with a staggering 60000% gain.

Thankfully buying the Amazon stock is a very easy task. Just follow the next steps and you'll be able to buy Amazon shares in less than 3 minutes.

Quick Guide - How to Buy Amazon Shares in the UK

Step 1: Download the Wealthyhood app.

Step 2: Signup for a free account

Step 3: Complete the W-8BEN Form

Step 4: Top - Up your account

Step 5: Select the Amazon Stock

Step 6: Specify the amount of Amazon shares you would like to buy

Step 7: Hit "Buy" and then submit your order

And that's it. Investing in Amazon is as simple as following the 6 steps presented above.

Buy Amazon SharesHow to Sell Amazon Shares?

Selling Amazon shares is as easy as buying them.

From your dashboard in the Wealthyhood app you can select the Stock or the ETF you want to sell. In this case you can tap on Amazon, assuming you have already bought it.

On the next step, select "Sell" and you are good to go.

Once you have sold your stock you can withdraw your money to your bank account.

What about the fees?

Wealthyhood offers commission-free investing which means that you won't be charged for any of your buying and selling (even if you use the free plan)

How to Invest in Amazon in the UK? Detailed Guide

If you previously read my guide about how to buy Netflix shares you already know how to buy stocks in the UK. Investing in Amazon in the UK involves a similar process. Buying Amazon shares is a process that involves a lot of research. Investing in any company should be taken seriously as investing carries a lot of risks and can cause permanent loss of funds.

Here is how you can start investing in Amazon with the help of an investing app.

1. Signup on an Investing Platform or use an Investing App

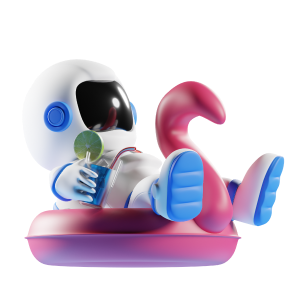

There are multiple investing apps, investing platforms as well as robo advisors and micro investing apps available in the UK that I have reviewed previously. Wealthyhood is an investing app designed for long-term investors who are looking to DCA and strategically grow their portfolio. The app is free to use and offers 0 fee commissions and we will show you how you can utilize Wealthyhood's tools to invest for the long term.

Try Wealthyhood2. Complete the W - 8BEN Form

This step is facilitated automatically by Wealthyhood to make your onboarding as smooth as possible.

Completing the W-8BEN form is a crucial step for non-U.S. residents who earn income from U.S. sources, allowing them to claim tax treaty benefits, including reduced rates of withholding tax. This form serves as a declaration of one's foreign status and eligibility for these benefits, ensuring compliance with U.S. tax laws while potentially lowering the tax burden on U.S.-sourced income.

3. Top - Up Your Account

To buy shares in Amazon you will first need to top up your account with the amount of money you would like to invest. Just go to "Account" in the Wealthyhood app and select "Top Up". From there you can specify the amount you would like to add to your account.

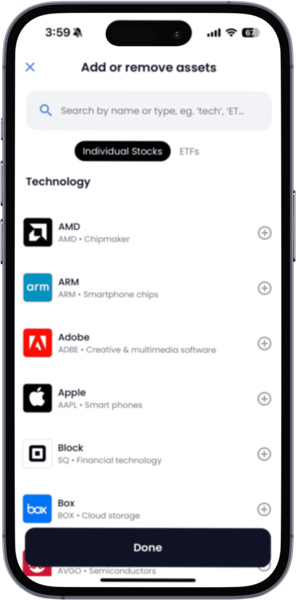

4. Choose The Amazon Stock

Once you have funded your account, you can go back to "Target". In the target portfolio, you can select how to structure your portfolio. Type Amazon in the search bar and select Amazon. If you want to buy only Amazon shares you should select only Amazon. However, you can also include more stocks to diversify your portfolio and minimize your risk.

Buy Amazon Stock

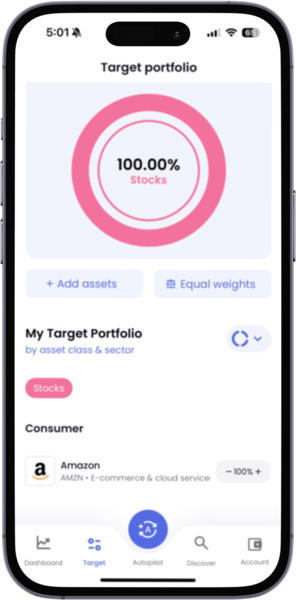

Buy Amazon Stock 5. Construct your portfolio

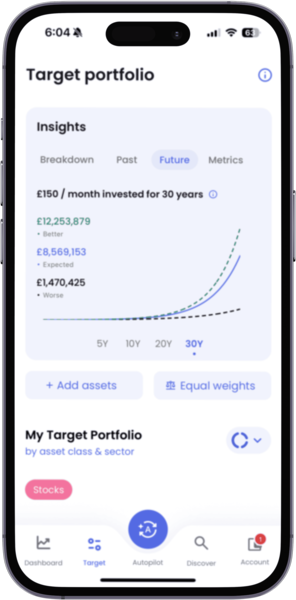

Constructing your portfolio involves selecting a mix of investments that align with your long-term goals and risk tolerance. This step is about diversification, balancing between stocks, bonds, real estate, and other assets to minimize risk while aiming for a desired return. Regular rebalancing ensures your portfolio stays on track.

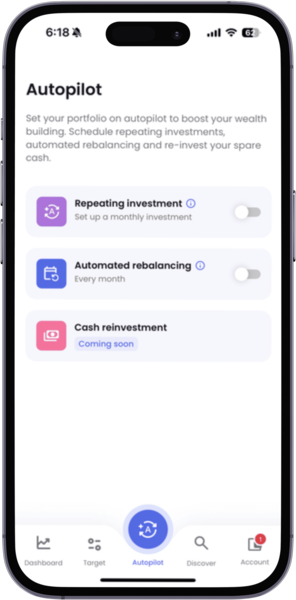

6. Set Up a recurring monthly investment

Setting up a recurring monthly investment is a powerful strategy to grow your wealth over time. It involves automatically investing a fixed amount of money into your portfolio every month, regardless of market conditions. This approach, known as dollar-cost averaging, can reduce the impact of volatility and help build investment discipline.

7. Monitor your Amazon Investment

Monitoring your investments is a critical aspect of managing your portfolio. It involves regularly reviewing your investment performance and making adjustments as needed to align with your financial goals and market conditions. This may include rebalancing your portfolio, reinvesting dividends, or changing your investment strategy based on life changes.

8. Calculate and Pay your Taxes

Doing your taxes is a vital annual task for UK investors, involving the accurate reporting of income and capital gains from investments to HM Revenue and Customs (HMRC). It's essential to be aware of your tax allowances, such as the Capital Gains Tax allowance and the Dividend Allowance, to optimize tax efficiency. Utilizing tax-advantaged accounts like ISAs and pensions can significantly reduce your tax liability, maximizing the growth of your investments. Staying informed about tax changes and seeking professional advice if necessary can ensure compliance and optimize your financial strategy.

Buy Amazon SharesPlease keep in mind that investing involves risks. I am not a financial advisor and this article was created based on my own research. Feel free to do your due diligence before buying a company stock. You can also read our guide on how to invest in the stock market to better understand the strategies and processes involved when buying shares in a company. If you would like to discuss more on the Stock Market feel free to drop me an email at george@wealthyhood.com or connect with me through LinkedIn.

Amazon Company Updates and News as of March 2024

Earnings came in strong for Amazon for Q4 2023: Net Sales increased by 14% to $170 Billion compared to $149.2 Billion in Q4 2022.

Significant Financial Growth in 2023: The company reported a substantial increase in operating income to $13.2 billion in Q4 2023 from $2.7 billion in the same quarter the previous year, with net income rising to $10.6 billion, or $1.00 per diluted share, from $0.3 billion, or $0.03 per diluted share.

Strong Performance Across Segments: The North America segment turned a previous operating loss into a $6.5 billion income. Meanwhile, the AWS segment's operating income grew to $7.2 billion from $5.2 billion, and the International segment reduced its operating loss significantly.

Yearly Financials Show Broad Improvement: For the full year, net sales rose 12% to $574.8 billion, with operating income improving to $36.9 billion from $12.2 billion in 2022. Net income for the year was a robust $30.4 billion, or $2.90 per diluted share.

Cash Flow and Free Cash Flow Improvements: Operating cash flow increased 82% year-over-year, and free cash flow showed a remarkable improvement, turning a previous outflow into an inflow of $36.8 billion.

Customer Experience and New Ventures: Amazon focused on enhancing customer experience and expanding into new ventures, such as launching online vehicle sales with Hyundai, offering healthcare through One Medical for Prime members, and expanding Amazon Fresh grocery delivery services.

Is it a Good Time to Buy Amazon Shares?

Exploring the investment landscape, particularly in powerhouse companies like Amazon, requires a nuanced and deeply personal analysis. Reflecting on my approach to understanding Amazon's potential, I've considered a broad spectrum of factors. Amazon isn't just an e-commerce giant; it's a multifaceted entity with significant stakes in cloud computing, AI, and a growing presence in healthcare and media. This diversification suggests resilience and potential for sustained growth, qualities that are attractive to any investor looking for long-term holdings.

However, Amazon's sprawling empire and its ambitious expansion come with complexities. The regulatory landscape is shifting, with increased scrutiny on big tech, which could pose challenges. Additionally, competition is fierce in many of Amazon's domains, not least from other tech giants and nimble startups.

You should also Amazon's consider historical performance, innovation trajectory, and the caliber of its leadership. The company has consistently demonstrated an ability to pivot, innovate, and capture market share in emerging sectors. This adaptability is crucial in the fast-evolving tech and retail landscapes.

For someone contemplating an investment in Amazon, I'd suggest considering the company's long-term potential versus the inherent volatility of the stock market. It's also worth reflecting on Amazon's strategic moves, such as its foray into new markets and technologies, which could fuel future growth.

In essence, deciding whether to invest in Amazon shares is a personal decision that should be informed by a comprehensive analysis of the company's fundamentals, market position, and growth prospects, alongside a consideration of broader economic conditions and individual financial goals. Diversification and due diligence are key, as is a steady focus on long-term investment horizons over short-term fluctuations.

Amazon Stock Forecast and Price Predictions

The future trajectory of Amazon's stock price sparks considerable interest and debate among investors and analysts alike, reflecting a mix of optimism and calculated forecasts based on the company's past performance, current market position, and future growth potential. According to recent analysis and price targets provided by various financial institutions, there's a consensus that Amazon's stock could experience significant growth, with predictions for its price ranging widely but showing upward potential.

2024 Forecast: Amazon continues to expand its reach beyond e-commerce into cloud computing, advertising, and even healthcare. Analyst consensus, taking cues from Amazon's aggressive growth in AWS and its advertising ventures, suggests a bullish outlook. My analysis, melded with expert insights, predicts a moderate uptick in stock price, buoyed by these expanding revenue streams. The P/E ratio, though still high, reflects growth expectations, making a case for potential price levels to hover around the $150-$160 mark.

2025 Outlook: The year 2025 promises to be a watershed moment for Amazon, as it potentially capitalizes on its investments in logistics and AI technology. Assuming steady growth in AWS and a successful expansion into new markets, I project a more substantial stock price increase. The e-commerce giant's foray into emerging markets and the stabilization of its retail arm could propel stock prices to between $170 and $190, barring significant regulatory hurdles.

2026 Projections: By 2026, Amazon's commitment to sustainability and renewable energy is expected to start paying dividends, both ethically and financially. With the global push towards green initiatives, Amazon's leadership in this area could endear it further to consumers and investors alike. Predicting the exact stock price becomes trickier with time, but a trajectory towards the $200-$220 range isn't unfounded, assuming continued dominance in its core businesses and successful integration of its newer ventures.

2030 Vision: Looking further ahead to 2030, envisioning Amazon's stock price trajectory involves broader market and technological trends. The potential widespread adoption of AI, further advancements in cloud computing, and the evolution of consumer habits could significantly influence Amazon's operations. If Amazon maintains its innovative edge and market leadership, it's conceivable we'll see stock prices soar well beyond the $250 mark, reflecting the company's adaptability and enduring growth.

Underpinning Factors and Analysis

Several key factors underlie these forecasts:

AWS Growth: Amazon's cloud computing arm remains a significant growth driver. Analysts from major financial institutions underscore AWS's expanding market share and the cloud sector's overall growth as critical to Amazon's valuation.

E-commerce Dominance: Despite increasing competition, Amazon's e-commerce platform benefits from unparalleled scale and efficiency. Its ability to integrate new technologies and enhance the customer experience keeps it at the forefront of retail.

Diversification: Amazon's foray into advertising, healthcare, and potentially even autonomous vehicles presents new revenue channels. The successful monetization of these ventures could substantially impact its stock value.

Regulatory Environment: Potential antitrust actions and regulatory scrutiny, particularly in the U.S. and E.U., pose risks. The outcomes of such challenges are pivotal to Amazon's operational freedom and, by extension, its stock performance.

Global Economic Conditions: Macro-economic factors, including interest rates, inflation, and consumer spending trends, will invariably affect Amazon's business and stock price.

In synthesizing these insights, it's evident that Amazon's journey is one of innovation, diversification, and sometimes disruption. While exact stock prices are challenging to pinpoint, the direction of travel, underpinned by solid fundamentals and strategic foresight, suggests a trajectory of growth. As always, investing in stocks carries risk, and Amazon is no exception. Investors should conduct their due diligence, keeping abreast of market changes and company developments, to make informed decisions.

How High Can the Amazon Stock Go?

Analysts have set a broad spectrum of price targets for Amazon in the upcoming year, suggesting both confidence in the company's enduring growth and an acknowledgment of the uncertainties inherent in the market. Recent upgrades and positive outlooks from firms like Roth Mkm, Wells Fargo & Company, and Deutsche Bank Aktiengesellschaft have set price targets as high as $230, indicating a substantial upside from current levels. This optimism is mirrored by a "Strong Buy" consensus from numerous analysts who see Amazon continuing to outperform in the market, bolstered by its diverse business units, including AWS, advertising, and e-commerce.

A significant driver for this bullish outlook is Amazon's expanding presence in the digital advertising space, anticipated growth in AWS, especially in enterprise AI, and expectations of margin expansion across its segments. The advertising sector, in particular, is seen as a key revenue and margin booster, with projections of increased spending during events like the U.S. Presidential elections and the Paris Olympics potentially benefiting Amazon. Furthermore, the company's strategic pivot towards AI and cloud computing services is expected to contribute meaningfully to its revenue growth, with AWS expected to see reacceleration in its growth rate.

Considering these factors, it seems the consensus among analysts is not just blind optimism but is grounded in Amazon's proven ability to innovate, diversify its revenue streams, and expand its market leadership in key areas. Despite the high price-to-earnings ratio compared to its FAANG peers, the general sentiment suggests that Amazon's stock has room to grow, underpinned by solid fundamentals and strategic moves that could drive further gains.

Nonetheless, while the outlook is predominantly positive, potential investors should approach with due diligence, keeping in mind the broader market dynamics, regulatory challenges, and the inherent volatility of tech stocks. The ambitious targets set by analysts reflect a blend of Amazon's historical growth patterns and its strategic positioning for future expansion, making it a stock to watch closely for those interested in long-term investment opportunities.

Amazon Stock Fundamentals

Investing in stocks in the UK requires a deep dive into Amazon's stock fundamentals reveals a story of resilience, innovation, and growth potential that's worth exploring for any investor. At the time of writing the stock is trading at $180.06, reflecting a slight increase of $0.35 or 0.20%, and a volume of 9,819,489, the metrics paint a picture of a company in a strong trading position. Moreover, its 52-week range from $96.29 to $181.41 showcases the volatility and the recovery trajectory Amazon has been on.

Market Capitalization and Share Statistics

Amazon boasts a staggering market capitalization of $1.87 trillion, underscoring its colossal presence in the global market. With 10.39 billion shares outstanding and a 10-day average volume of 36.20 million, the stock demonstrates robust liquidity and investor interest. This level of market cap not only reflects Amazon's vast operational scale but also its investors' confidence in the company's growth trajectory.

Financial Ratios and Profitability

The company's earnings per share (EPS) stand at $2.89, with a trailing price-to-earnings (P/E) ratio of 62.32, indicating a premium valuation that investors are willing to pay for its future growth prospects. The forward P/E ratio, at 43.76, suggests that earnings are expected to improve, offering a slightly less expensive valuation in the future. Amazon's EBITDA is an impressive $85.515 billion, a testament to its operational efficiency and profitability.

Revenue figures are equally compelling, with a total of $574.785 billion over the trailing twelve months (TTM), supported by a gross margin of 46.98%. This margin level is indicative of Amazon's strong pricing power and cost management capabilities. However, the net margin of 5.30% points to potential areas for improvement in efficiency or cost reduction to bolster the bottom line.

The debt to equity ratio stands at 41.49%, showing a balanced approach to financing that leverages debt without overburdening the equity holders. This is crucial for sustaining growth and financing new ventures without compromising financial stability.

Future Prospects and Investment Considerations

Looking ahead, Amazon's beta of 1.17 suggests that its stock is moderately more volatile than the market, a common characteristic of tech giants with high growth expectations. The company's significant year-to-date performance increase of 18.63% reflects a positive market sentiment and confidence in its strategic direction.

Investors are keenly awaiting the next earnings report on April 25, 2024, for further insights into Amazon's performance and strategic initiatives. As the company navigates the complexities of global e-commerce, cloud computing, and AI technology, its ability to innovate and capture new market opportunities will be crucial for sustained growth.

Amazon's stock fundamentals present a compelling case for investors, underscored by its robust market presence, solid financial performance, and promising growth trajectory. While the high P/E ratio signals high expectations for future earnings growth, the company's diverse revenue streams, operational efficiency, and strategic investments in technology and global expansion provide a solid foundation for optimism. As always, potential investors should conduct thorough research and consider their risk tolerance and investment horizon before making decisions in this ever-evolving market landscape.

How to Research the Amazon Stock

Evaluating Amazon's stock is a complex but fascinating endeavor that goes beyond mere numbers. It requires an understanding of various financial metrics, market position, and the broader economic landscape. Here's how I approach the in-depth analysis of Amazon (AMZN) as an investment opportunity.

1. Price-to-Earnings (P/E) Ratio: This classic valuation metric is a starting point but understand its nuances. Amazon traditionally trades at a high P/E ratio compared to the broader market, reflecting its growth potential. However, the raw number needs context—compare it against Amazon's historical P/E and those of its sector peers to gauge if the stock is overvalued or undervalued based on earnings expectations.

2. Price-to-Sales (P/S) Ratio: Given Amazon's fluctuating profitability due to its reinvestment strategy, the P/S ratio offers another valuation perspective. It's crucial to see how this figure trends over time and in relation to competitors. A lower P/S ratio might indicate a more attractively priced opportunity relative to its sales.

3. Gross Margin and Operating Margin: Amazon's margins provide insights into its operational efficiency and profitability. I delve into segment-specific margins, especially AWS, its cloud computing arm, which has historically boasted higher margins than its e-commerce business. Understanding the shifts in these margins can indicate changing business dynamics or efficiencies gained through scale.

4. Revenue Growth Rate: As a growth-focused investor, Amazon's top-line growth is paramount. I analyze the quarterly and annual growth rates, but also the sources of that growth. Diversification into higher-margin businesses like AWS and advertising significantly impacts long-term sustainability.

5. Free Cash Flow (FCF): FCF is a critical indicator of financial health, showing how much cash Amazon generates after capital expenditures. It's a metric I closely monitor, as it reflects the company's ability to invest in growth opportunities, pay down debt, or potentially return value to shareholders in the future.

6. Return on Equity (ROE) and Return on Assets (ROA): These metrics assess Amazon's efficiency in generating profits from its equity and assets, respectively. While Amazon might have lower ROE and ROA figures compared to some peers due to its massive reinvestment, significant improvements or declines can signal changes in operational efficiency.

7. Amazon's Ecosystem and Market Expansion: Beyond the numbers, Amazon's strategic position and market expansion efforts are crucial. Its foray into new markets, ability to disrupt traditional industries, and create an integrated ecosystem offer qualitative measures of its growth trajectory and competitive moat.

8. Competitive Landscape: Analyzing Amazon's competitive stance in various segments against giants like Microsoft, Google, and emerging players helps me gauge its potential to sustain and grow its market share.

9. Economic and Regulatory Environment: Finally, macroeconomic factors and regulatory issues can have material impacts on Amazon's business model. From antitrust inquiries to international trade policies, staying abreast of these aspects is essential for a holistic evaluation.

In my analysis, triangulating these metrics and factors provides a comprehensive view of Amazon's investment potential. It's not just about one number or trend but how they interplay to shape Amazon's future. Investing is inherently risky, and such a detailed approach helps me make informed decisions aligned with my investment thesis and risk tolerance.

Is Amazon Listed on the UK Stock Exchange?

Amazon's stock, known by its ticker symbol AMZN, is primarily listed on the NASDAQ stock exchange in the United States. This is one of the most prominent exchanges globally, known for its heavy concentration of technology and internet-based companies. Amazon is not directly listed on the UK Stock Exchange. However, investors in the UK interested in buying Amazon shares can do so through various means, such as purchasing shares via platforms that offer international trading capabilities or through derivatives like Contracts for Difference (CFDs) and Exchange-Traded Funds (ETFs) that include Amazon in their portfolio. These financial instruments can provide a way for UK investors to gain exposure to Amazon's stock performance without a direct listing on the London Stock Exchange.

Buy Amazon SharesDoes Amazon Pay Dividends?

Amazon hasn't paid dividends to its shareholders, choosing instead to reinvest profits back into the company. This strategy isn't uncommon among tech giants and growth-focused firms. Dividends, essentially, are a share of a company's earnings distributed to its shareholders, often seen as a sign of the company's financial health and a method to return value to shareholders. Typically, companies that offer dividends are appealing to investors looking for a steady income from their investments, such as retirees.

The allure of dividends lies in the consistent income they can provide, alongside any potential capital gains from the appreciation of the stock itself. However, companies like Amazon prioritize growth and expansion over distributing profits as dividends. This reinvestment strategy can lead to significant long-term value for shareholders if the company continues to grow and its stock price appreciates. So, while Amazon's current lack of a dividend payment might seem a drawback for income-focused investors, the company's potential for substantial growth and value appreciation offers a different kind of investment allure.

What Are the Costs of Investing in Amazon?

Investing in Amazon, from my perspective as a professional investor, involves considering a variety of costs, both direct and indirect. Direct costs are relatively straightforward, including the share price itself, which, given Amazon's status as a tech giant, can be quite high compared to many other stocks. This means a significant initial investment is often required to own a meaningful number of shares. Besides the purchase price, trading fees or commissions, though minimal or non-existent on many platforms nowadays, can still apply, especially for international investors or those using premium brokerage services.

Indirect costs, however, are where the nuances of investment strategy come into play. The opportunity cost of investing a large sum in Amazon shares must be considered against potential gains from diversifying across a broader portfolio of stocks. There's also the cost of potential volatility; Amazon's stock, while historically showing impressive growth, can experience sharp fluctuations, reflecting broader market trends, regulatory changes, or company-specific news.

As an investor, it's crucial to weigh these costs against the potential for Amazon's continued expansion and dominance in e-commerce and cloud computing. The decision to invest in Amazon should align with one's investment goals, risk tolerance, and time horizon, understanding that, like all investments, Amazon shares come with no guaranteed return.

Best Investment Platforms to Buy the Amazon Stock

For those in the UK looking to invest in Amazon stock, Wealthyhood, Nutmeg, and eToro emerge as excellent platforms, each catering to different investor needs and preferences.

Wealthyhood is celebrated for its beginner-friendly approach, enabling investors to start with as little as £1. Its platform is designed to demystify investing through intuitive tools, educational resources, and tailored guidance, making it a great entry point for new investors seeking to build a diversified portfolio over time.

Try WealthyhoodNutmeg stands out as a leading Robo Advisor Platform, ideal for those preferring a hands-off investment strategy. By answering an investment questionnaire during onboarding, Nutmeg crafts a portfolio tailored to your goals, timeline, and risk tolerance. It's a fully managed service, meaning Nutmeg takes care of all the investment decisions, rebalancing, and optimization, making it suitable for investors who'd rather not dive into the daily details of stock trading. With a minimum investment of £500 or £50 with a monthly contribution, Nutmeg is accessible to a broad range of investors, offering both standard portfolios and socially responsible investing options.

eToro is renowned for its social trading experience, allowing users to engage with other investors, follow leading traders, and even replicate their trading strategies. This platform is particularly appealing for those interested in a more collaborative approach to investing. With a minimum account opening balance of just £7.50, eToro makes it accessible for beginners to start investing, also offering a zero-commission model on stock and ETF trades, which is attractive for those looking to minimize costs.

Each platform has its unique strengths: Wealthyhood for its educational approach and low entry point, Nutmeg for its fully managed portfolios and ethical investment options, and eToro for its social trading features and diverse asset offerings. Depending on your investment style, preferences for engagement, and whether you're looking for a hands-on or hands-off approach, these platforms provide robust options for investing in Amazon from the UK.

Wrap Up

In conclusion, purchasing Amazon shares in the UK is a viable option for investors looking to diversify their portfolio with a stake in one of the world's leading tech giants. By navigating through direct and indirect costs, understanding the nuances of investment platforms, and considering the broader economic factors that influence Amazon's stock price, investors can make informed decisions.

Whether you're a seasoned investor or a newcomer to the stock market, the key to success lies in thorough research, strategic planning, and aligning your investment choices with your financial goals and risk tolerance. Remember, investing in stocks like Amazon carries the potential for both growth and volatility, making it essential to stay informed about market trends and company developments. With the right approach, investing in Amazon shares in the UK can be a rewarding part of your investment journey, offering the chance to be part of the ongoing success story of a global tech powerhouse.

I am always reachable on Linkedin or via email at george@wealthyhood.com. My goal is to educate Wealthyhood's readers and for this reason I am happy to answer question regarding investing and the content presented in Wealthyhood's blog so fee free to connect with me and ask questions or share your views regarding investing.

Capital at risk. This article is for information purposes only and is not investment advice nor a recommendation. You should consider your own personal circumstances when making investment decisions. Past performance is not a reliable indicator of future performance. Tax treatment depends on your personal circumstances and rules can change.