If you've been following the stock market it's reasonable to wonder how to buy Netflix shares since the company has been on a massive rally for the past 10 years.

In this article, I am going to explore how you can buy the Netflix stock but I will also provide you with an analysis and the core metrics of the company which will help you make better investing decisions.

Buying shares in Netflix in the UK (NFLX) is a fairly easy task especially if you use a user-friendly investing app like Wealthyhood.

How to Buy Netflix Shares?

Step 1 - Open a Free Wealthyhood Account

Wealthyhood offers an investment app and an investment platform that you can access from your Android or IOS device or through your computer. This is, hands down, the quickest way to invest in Netflix for UK users.

Creating an account is a very simple task. You will just have to fill in your details.

To open an account just click the button below.

Buy Netflix Stock

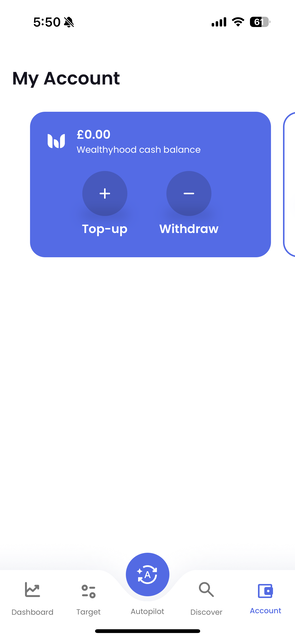

Step 2 - Top Up Your Account

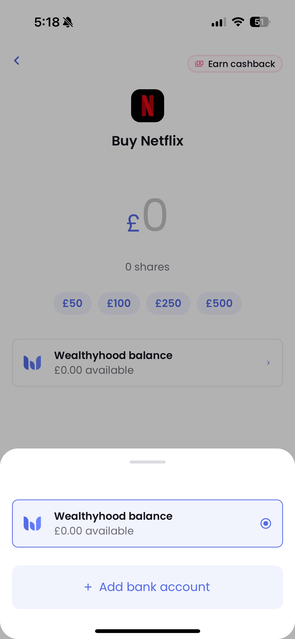

Once you have completed your registration you will be asked to top up your account.

You can choose the amount you want to add to your account and then proceed to link Wealthyhood with your bank account.

Step 3 - Add Netflix Stock to Your Portfolio

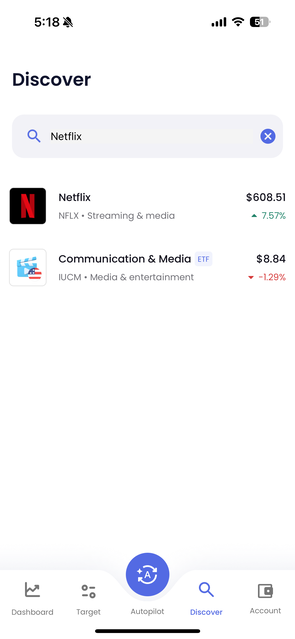

Go to the Discover page to see all the available stocks and ETFs.

Type Netflix in the search bar at the top of the screen and you will find Netflix. Click on it and the on next page you can specify the amount you would like to spend. (You don't have to buy a whole stock. Wealthyhood app allows for buying fractional shares which means that you can buy just a part of a Netflix stock.

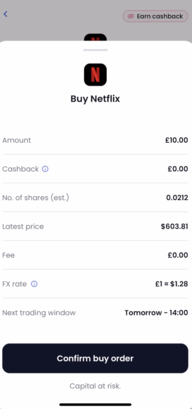

Step 4 - Submit the Order

Once you have selected the amount you would like to spend you just have to submit the order. Note that after submitting the order it may take some time until it's filled but this is completely normal.

Step 5 - Monitor Your Portfolio

Your investment journey doesn't stop at buying the Netflix share. You still need to do your due diligence stay updated on how the company is progressing and keep an eye on important metrics like the P/E ratio. You can check your portfolio's progress right from the dashboard. In the Wealthyhood app you can also find the latest news regarding markets and eco

Investing involves risks so you need to stay updated on the company's outlook to avoid.

Buy Netflix StockStep 6 - How to Sell Netflix Shares (Optional)

Selling your Netflix stocks and shares is as simple as buying them.

Go to your dashboard and select the Netflix stock (NFLX). On the next screen you choose "Sell" and then you will be prompted to specify the amount of stocks you would like to sell. You can sell all of your stocks or just some them. Once you have sold your stock you will also be available to withdraw the money to your bank account or buy another stock or ETF.

And that's it. Selling or buying Netflix shares is as simple as that. However, investing in Netflix stock, or pretty much any stock involves many risks. Remember that if you are blindly investing in a stock then you are probably gambling.

Investing is a process that involves research and investors should do their due diligence before dipping their toes into the stock market. If you would like to know how to evaluate a stock keep reading. Below you'll find an analysis of the Netflix stock and a guide on what to look for and how to research a company before investing into it.

I am not a financial advisor, and this article is not an investment advice. I am creating these guides to help Wealthyhood's audience learn more about how to invest in the stock market but you should always do your research before buying a stock. If you would like to discuss more on the Stock Market feel free to drop me an email at george@wealthyhood.com or connect with me through LinkedIn.

How to Invest in Netflix - What to Look For?

As I said in my guide about how to buy Amazon shares in the UK, investing in Netflix or any stock is a process that requires an in-depth analysis of the company's core metrics, management team, important financial KPIs, and more. Here is a checklist of things that I would like into before buying shares in Netflix:

Investment Goals:

What are you looking to achieve? Are you a short-term trader or a long-term investor?

Assess your risk tolerance. If you are risk averse then NFLX might not be a great buy for you

Define your investment objectives (growth, income, preservation of capital).

Conduct Fundamental Analysis:

Earnings Growth

: How much have Netflix's earnings grown over the years? (You can find more on that later in this article)

Revenue Growth

: Evaluate the company's year-over-year revenue growth.

Profit Margins

: High and improving profit margins can indicate efficiency and control over costs.

Return on Equity (ROE)

: Measures how effectively management is using a company’s assets to create profits.

Debt-to-Equity Ratio

: A lower ratio generally indicates a less risky investment.

Examine the Company’s Competitive Position:

Understand Netflix's competitive advantage (brand recognition, proprietary technology, market share).

Analyze the industry dynamics and the company’s position within the industry.

Review the Management Team:

Research the experience and track record of the company's leadership.

Consider the management's vision and strategy for future growth.

Valuation Metrics:

Price-to-Earnings (P/E) Ratio

: Compare the P/E ratio with industry peers to gauge if the stock is overvalued or undervalued.

Price-to-Book (P/B) Ratio

: Useful for assessing companies with significant tangible assets.

Price-to-Sales (P/S) Ratio

: Helpful for evaluating companies that are not yet profitable.

Dividend Yield

: Important for income-focused investors.

Understand the Risks:

Assess the company-specific risks (regulatory, competitive pressures, operational risks).

Consider market-wide risks and how they might impact the stock.

Review Historical Performance:

While past performance is not indicative of future results, understanding historical trends can provide context.

Read the Company’s Financial Statements:

Analyze the balance sheet, income statement, and cash flow statement for financial health.

Pay attention to the footnotes for additional insights and potential red flags.

Consider Market Sentiment and Analyst Opinions:

Review analyst ratings and research reports.

Be aware of market sentiment and how it might affect stock performance.

Diversify Your Portfolio:

Avoid putting all your eggs in one basket. Diversification can help mitigate risk.

Monitor and Review Your Investment:

Keep abreast of quarterly earnings reports and any news related to the company.

Be prepared to adjust your investment strategy as necessary based on performance and changing objectives.

Netflix Stock Analysis and Core Metrics

Metric | Value | Description |

Market Cap | 260 Billion | Total market value of a company's outstanding shares |

PE Ratio (TTM) | 50.87 | Price to Earnings Ratio, trailing twelve months |

EPS (TTM) | $12.03 | Earnings Per Share, trailing twelve months |

Revenue Growth (YoY) | 6.67% | Year-over-year revenue growth |

Dividend Yield | Netflix stock doesn't pay dividents | Percentage of stock price paid as dividend |

52-Week High | 624.41 | Highest stock price in the last 52 weeks |

52-Week Low | 285.59 | Lowest stock price in the last 52 weeks |

Revenue | 33.7 Billion | Measure of stock's volatility about the market |

Reviewing and analyzing stocks is a complicated that involves many different variables. Professional traders and investors are looking into multiple KPIs before buying a stock but for the sake of simplicity, I will only mention some of the most important ones that can provide you with a solid understanding of a Stock's health and trajectory.

- Market Cap, or Market Capitalization, is essentially the total value of a company's shares; think of it as how big a splash the company makes in the stock market pool.

- The P/E Ratio, or Price-to-Earnings ratio, is a bit like comparing the price of a cinema ticket to the quality of the film—it tells you whether the stock's price is high or low compared to its earnings.

- Earnings Per Share (EPS) gives you the lowdown on the company's profitability divided by the number of available shares, sort of like how a film's box office take is divided among its producers.

- Revenue Growth (YoY) shows how much the company's revenue has grown from one year to the next, indicating whether it's more like a blockbuster hit or a straight-to-DVD flop.

- Dividend Yield is the portion of the company's earnings dished out to shareholders, akin to the royalties from a hit song.

- The 52-week High/Low provides the peaks and valleys of the stock's price over the past year, offering a sense of its volatility, much like the critical highs and lows of a film review. Beta measures the stock's volatility against the market; a high beta means more drama, while a low beta suggests a steadier plot.

When it comes to Netflix, I'm particularly interested in EPS and Revenue Growth (YoY) as these have been great indicators in the past of what is the fair value of the stock. However while these 2 metrics might tell the story for NFLX's fair price, it might not be the most objective way to measure the value of other stocks.

These metrics can tell you a lot about the company's current performance and future potential, kind of like scouting the next big director or franchise.

High EPS suggests profitability, while strong revenue growth signals that the company is expanding its audience. Together, they give a pretty good picture of whether Netflix is likely to be the next big hit or a costly flop. So, for those eyeing Netflix as a potential addition to their portfolio, these indicators are your guide to deciding if it's time to 'subscribe' to its stock.

Is Netflix a safe stock?

In my view, assessing the safety of Netflix's stock requires a nuanced understanding of both the company's position within the entertainment industry and its financial health as reflected by various market metrics. Netflix, with its pioneering role in streaming and its continuous investment in original content, has carved out a significant niche in the global market. This innovation and market leadership lend a degree of stability and growth potential to its stock, setting it apart from many traditional media companies.

However, when we talk about safety, it's crucial to consider volatility and the broader market context. Netflix's stock, like many in the tech and entertainment sectors, is subject to fluctuations driven by subscriber growth numbers, content acquisition costs, and competitive pressures. Its Beta value, an indicator of volatility, suggests that Netflix can be more susceptible to market swings than some more conservative investments. Yet, it's this same volatility that has historically provided significant growth opportunities for Netflix shareholders.

Comparatively, Netflix may not offer the same level of safety as stocks in more stable sectors like utilities or consumer staples, known for their lower volatility and consistent dividends. However, for investors with a higher risk tolerance and a long-term perspective, Netflix presents an attractive blend of growth and resilience. It's not the safest stock if we measure safety by low volatility and predictability alone, but its strong market position, potential for growth, and adaptability in the face of industry changes make it a compelling choice for those willing to navigate its ups and downs.

In summary, while Netflix isn't the safe harbor that more risk-averse investors might seek, it offers a valuable proposition for those looking to ride the waves of the entertainment industry's future, blending a moderate level of risk with the potential for substantial rewards.

Netflix's Financial Health and Growth Prospects

Looking at Netflix's current health as a company, it's quite intriguing. The firm has demonstrated a robust ability to dominate viewing shares across various markets, with significant leadership in places like Poland and Spain, according to a Seeking Alpha analysis. Their original content continues to capture the top spot in TV series and movies almost every week of the year, showcasing their content strategy's effectiveness.

Financially, Netflix's metrics are solid. The company's market cap stands impressively at around $260 billion, with an enterprise value of about $267 billion, suggesting a substantial market presence. Their trailing PE ratio is around 50.85, indicating a premium valuation that reflects high growth expectations. Interestingly, their forward PE ratio is considerably lower at 34.85, which points towards expected growth in earnings which is why I am interested in increasing my exposure to NFLX stock in the upcoming months.

Netflix's also PEG ratio, a measure that takes into account the stock's price, earnings, and growth, sits at 1.59, hinting at potentially reasonable pricing for its growth rate.

Yahoo Finance provides a detailed snapshot of Netflix's valuation, showing a significant 52-week price change and a Beta of 1.22, which suggests its price has been more volatile than the market average. This level of volatility, coupled with substantial revenue growth (YoY) and a notable increase in net income, positions Netflix as a potentially attractive but riskier investment.

Usually, when I am trying to identify a stock's financial health I am also looking at what other analysts think about it, including those from Seeking Alpha which seem optimistic about Netflix's trajectory.

In their respective articles, they underscore the company's strategic advantages, such as its expansive content library and ability to generate free cash flow. However, they also caution about challenges like increasing competition and market saturation in developed regions. The consensus suggests that while Netflix has inherent risks due to its sector and ambitious growth plans, its solid financials and strategic positioning could offer a rewarding investment for those willing to accept the associated risks.

In my opinion, Netflix appears to be a solid company with a strong market position and potential for future growth. However, its stock comes with inherent volatility and risk, reflecting its aggressive growth strategy and competitive industry landscape. While the current financial metrics and analysts' outlooks provide a compelling case for Netflix as an investment, potential investors need to consider their own risk tolerance and investment horizon before diving in.

Risks and Challenges for Netflix

Reflecting on the latest developments for Netflix, the company has demonstrated a remarkable ability to navigate the competitive streaming landscape. They've reported a notable surge in subscriber numbers—almost 9 million in the third quarter—and have strategically decided to raise prices in certain regions like the US, UK, and France. This move, coupled with initiatives such as the crackdown on password sharing and the introduction of an ad-supported offering, has pushed the stock higher in after-hours trading. Impressively, Netflix has managed to beat revenue expectations and guide to strong future earnings, underscoring the company's robust financial health and the effective execution of its strategic initiatives.

However, these developments are not without their challenges. Price hikes, while potentially beneficial for revenue, risk alienating a portion of the customer base, especially in a market teeming with competitive streaming options. The success of Netflix's ad-supported plan indicates a market appetite for lower-cost streaming options, but it's a delicate balance to maintain subscriber growth while also increasing average revenue per membership, a metric that reportedly faced a slight decline due to various factors.

From my perspective, Netflix's recent moves are bold yet necessary steps in an evolving digital entertainment environment. Their ability to grow subscriber numbers significantly and leverage new revenue streams, such as advertising, positions them well for sustained growth. However, the challenges of increasing competition, customer sensitivity to price changes, and the imperative to continually invest in compelling content are significant. Netflix's strategic decisions in these areas will be crucial to its long-term success and its ability to maintain its leading position in the streaming wars.

Overall, I view Netflix as navigating its current challenges with a strategic acumen that bodes well for its future, even as it faces the ongoing need to adapt and innovate in a rapidly changing market.

Analyst Opinions

While opinions vary, a general consensus among analysts is cautiously optimistic. JP Morgan's commentary on 'accelerating' revenue growth in 2024 reflects confidence in Netflix's ability to navigate market challenges and capitalize on its strengths.

However, analysts also caution investors about potential volatility and the need for Netflix to continuously innovate and adapt to maintain its competitive edge. The sentiment is that while Netflix presents a promising investment opportunity with significant growth potential, it is not without its risks.

Is NFLX Stock Overpriced?

Assessing whether Netflix's (NFLX) stock is overpriced involves diving into a mix of its valuation metrics, recent financial performance, and market dynamics. Traditionally, metrics like the Price-to-Earnings (P/E) ratio, Price-to-Sales (P/S) ratio, and the company's growth prospects are pivotal in such analysis. Netflix has a trailing P/E ratio significantly higher than the industry average, suggesting investors are paying a premium for its earnings compared to other companies.

However, a simple P/E analysis isn't the end-all-be-all; Netflix's forward P/E ratio, which considers future earnings expectations, appears more reasonable and indicates anticipated growth. This suggests the premium might be justified by the company's robust subscriber growth, international expansion efforts, and innovative content strategy.

Moreover, Netflix's strategic moves, like adjusting pricing models and investing heavily in content to maintain its subscriber base and attract new ones, hint at a forward-thinking approach. This, coupled with their performance on key financial metrics like revenue growth and operating margin expansion, points towards a healthy, growing company.

Yet, evaluating its Price-to-Sales (P/S) ratio and comparing it with industry standards reveals that the stock trades at a significant premium. This could be indicative of overpricing, especially when considering the intensifying competition in the streaming sector and the potential for market saturation.

To form a more holistic view, I examined Netflix's growth trajectory, strategic initiatives, and market positioning. My calculation weighed the current valuation metrics against the company's growth prospects and competitive environment. While the metrics may suggest a premium valuation, Netflix's strategic position, content portfolio, and global expansion plans provide a strong foundation for future growth.

In conclusion, while on the surface NFLX stock appears pricey based on traditional valuation metrics, a deeper dive into its growth prospects and strategic moves suggests the premium could be warranted. However, it's crucial to monitor market trends, competition, and Netflix's ability to execute on its growth strategies. Investing in such a high-valuation stock carries risks, and it's essential to balance optimism about future growth with the realities of potential market saturation and competitive pressures.

Does Netflix Pay Dividends?

Netflix (NFLX) does not currently pay dividends to its shareholders. This approach aligns with the company's strategy of reinvesting profits back into the business to fuel growth, content development, and global expansion. Given Netflix's focus on capturing more market share in the competitive streaming industry and investing heavily in original content, the decision not to pay dividends allows the company to allocate resources towards these growth initiatives. This strategy is not uncommon for tech and growth-oriented companies that prioritize expanding their operations and market presence over returning capital to shareholders through dividends.

Investors looking into Netflix as a potential addition to their portfolio should consider this aspect, especially if they are seeking income-generating investments. Netflix's investment appeal lies more in its growth potential and capital appreciation prospects than in immediate income return via dividends. As the streaming market continues to evolve, with increasing competition and new content creation, Netflix's focus remains on strengthening its position and enhancing its offering, suggesting that initiating dividend payments may not be on the company's agenda in the near term

Netflix’s 10 Year Returns

Netflix (NFLX) has been a phenomenal story of growth and transformation over the past decade, reshaping not only how we consume entertainment but also how investors view the stock in the broader market.

Over the past 10 years, the stock has returned approximately 1300% percent which is nothing less than impressive.

Reflecting on its performance, the company's stock has seen substantial appreciation, largely driven by its success in expanding globally, a sharp increase in subscriber numbers, and a robust content library that has resonated with a diverse audience.

To evaluate Netflix's 10-year returns, I would typically look at key financial metrics and stock performance data, including share price appreciation, market capitalization growth, and any strategic moves that significantly impacted the company's valuation. However, due to restrictions in accessing specific historical performance data during this session, I will base my analysis on the general knowledge that Netflix's stock has significantly outperformed many of its peers in the technology and entertainment sectors over the last decade. This remarkable run reflects not only the company's ability to innovate and capture market share but also on its foresight in capitalizing on the streaming trend early on.

From my perspective, and based on Netflix's trajectory over the past decade, investors who recognized the company's potential early on and held onto their shares have likely seen substantial returns on their investment. The stock's performance has been buoyed by Netflix's aggressive expansion into international markets, continuous investment in original content, and the strategic decisions to pivot fully into streaming, distancing itself from its DVD rental origins.

Conclusion

In conclusion, Netflix's journey over the past decade underscores a remarkable saga of innovation, resilience, and strategic foresight. As a trailblazer in the streaming industry, NFLX has not only redefined entertainment consumption globally but has also carved out a lucrative niche in the stock market, rewarding investors with impressive returns. Despite not paying dividends, the company's focus on reinvesting into growth initiatives, such as content creation and global expansion, has fueled its stock performance, making it a captivating case study for growth-oriented investors.

The challenges and risks inherent in Netflix's business model, including competition, market saturation, and the cost of content production, are significant. Yet, the company's adept navigation through these challenges and its ability to consistently grow its subscriber base and revenue streams highlight a robust business model and a forward-looking management team.

While assessing NFLX's valuation and future prospects requires careful consideration of various metrics and market dynamics, the stock's historical performance and the company's strategic positioning suggest that Netflix remains a compelling story within the tech and entertainment sectors. For investors looking for growth and willing to bear the associated risks, Netflix presents an intriguing investment opportunity, albeit with the understanding that the future is as unpredictable as the next hit series on its platform. As always, a balanced and well-researched approach will be key to navigating the opportunities and challenges that lie ahead for Netflix and its shareholders.