Interest rates in 2024 remain elevated and, UK savers have a prime opportunity to lock in highly competitive fixed term savings rates not seen in over a decade. This guide will highlight the most lucrative 1, 2, 3, and 5-year fixed rate bond deals currently available from credible providers in early 2024, helping you securely earn yields far outpacing standard instant access accounts.

Key Takeaways:

Top 1-year fixed bonds are offering interest rates over 5%, far exceeding regular savings deals. However, they require locking up £25,000+ for 12 months lacking flexibility.

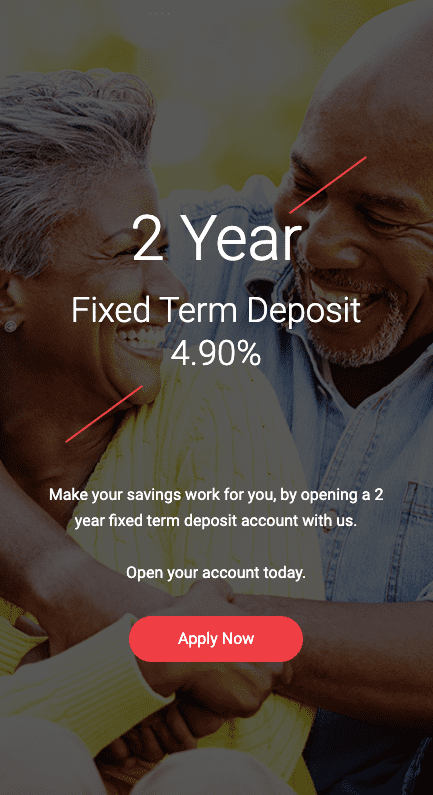

Leading 2-year fixed rate bond rates are hovering around 5%, also trouncing instant access returns. But you sacrifice access to funds for 24 months once deposited.

Competitive 3-year fixed bonds are guaranteeing 4-4.5% AER currently, substantially higher than cash pots. Yet money is completely illiquid for the full 36 months.

Average returns on top 5-year fixed rate bonds sit between 4-4.5% now, well above easy access accounts. Though tying up lump sums for 60 months delays flexibility.

Islamic fixed rate savings accounts consistently match their expected profit rates in practice historically. So Sharia options merit consideration from values-based investors too.

Best Fixed Rate Bonds by Term (2024)

Term | Top Picks | Key Features |

1 Year | Investec Bank, StreamBank, BLME, HBZ, LHV Bank | High interest rates (up to 5.30% AER), varying minimum deposits, online management options. |

2 Years | iFAST Global Bank, Investec Bank, Bank of Ceylon, Zenith Bank, BLME | Interest rates around 5%, varying minimum deposits, options for annual interest credit. |

3 Years | Zenith Bank, BLME, Isbank UK, RCI Bank, Paragon Bank | Interest rates up to 4.7% AER, options for annual interest credit, green investment choices. |

5 Years | Isbank UK, BLME, UBL UK, RCI Bank, Paragon Bank | Competitive rates (up to 4.5% AER), options for annual interest distribution, eco-friendly investments. |

Please note that none of the below is financial advice. The fixed-rate bonds presented below are just my favorite picks and the reasons are explained under each fixed-rate bond. Please make sure that you do your own research.

Glossary and Jargon Treatment

Feature/Advantage | Description |

Fixed-Rate Bonds Definition | Savings option for earning interest on a lump sum over a set period (1-5 years), with a guaranteed fixed annual interest rate. |

Locked Interest Rates | Annual interest rate is fixed for the bond's full term, providing certainty over returns. |

Fixed Terms | Terms typically range from 1 to 5 years. Early withdrawal incurs penalties. |

FSCS Protection | Bonds are protected up to £85,000 per licensed bank in the UK. |

Tax Treatment | Interest is taxable, paid gross without tax deducted. Higher rate taxpayers must declare interest. |

Higher Interest Rates | Offers higher rates compared to instant access savings accounts (over 2% in many cases). |

Suitability | Ideal for retirees, conservative investors, first-time buyers, and parents saving for education. |

Risk Mitigation | Useful for medium-term goals, provides market volatility shelter, and aids in financial planning. |

Best 1 Year Fixed Rate Bonds and Savings Accounts

With interest rates rising, we've seen some highly competitive 1-year fixed savings deals launch over the past year from challenger banks and lesser-known deposit takers aiming to raise funds. Based on the latest January 2024 rates, these make my shortlist for 12-month bonds targetting the highest returns.

Investec Bank 1-Year Fixed Saver

On the top of my llist is the Investec Bank plc 1 Year Fixed Rate Saver which recently increased its interest rate to a market-leading 5.30% AER fixed for the 12 month term deposit. This account particularly appeals to me since Investec is a large, established player, providing security for such a high yield.

The minimum deposit is on the larger side at £25,000. But for savers able to lock this sum upfront, you’d earn over £1,300 in gross interest payments after 1 year at this industry-leading 5.3% annual rate, paid upon maturity. With other fixed-term bonds rarely exceeding 2-3% in recent years, this is an eye-catching short-term yield in my opinion.

Having the ability to open/manage online or via a UK-based relationship manager also provides account flexibility. So if you have sufficient reserves to meet the minimum investment, this in my book is the top 1 year fixed deal.

If you are particularly interested in this type of fixed-rate bond you can read our research article for the best 1 year fixed rate bonds.

StreamBank Fixed Rate Issue 9

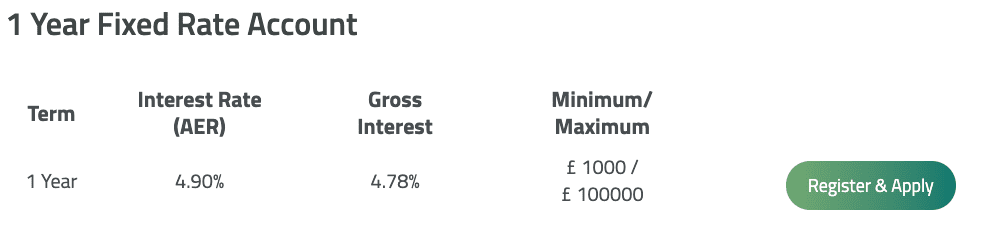

Another super competitive 1-year option I’m watching is StreamBank’s Fixed Rate Account - Issue 9 which also requires a £25k deposit at present rates. This account guarantees a 4.90% AER fixed return over the 12-month term, with all interest paid at maturity rather than incrementally.

This lacks the reputation of Investec, but as a saver purely chasing high yields for short-term parking of funds, it offers an unmatched return for just a 1 year lock-in timeframe, fixed close to 5%.

StreamBank also provides customers the choice of managing the account entirely digitally or via postal correspondence is a differentiation point as well. For the absence of withdrawal access, this 12-month yield is tempting.

BLME Premier Deposit Account

Now if seeking a Sharia-compliant fixed-term product with no guaranteed rates offered, my top contender is the Bank of London and Middle East’s Premier Deposit Account. While advertised as an expected profit rate, BLME’s 1-year short account has historically paid virtually the same anticipated annual equivalent rate of 5.05% upon maturity.

I like the accessibility too - requiring just a £1,000 minimum deposit, it’s perfect for those looking to invest a smaller sum but want to enjoy yields exceeding 5% in under a year. Do note this is an Islamic fixed term product not a traditional bond, where instead of receiving interest, returns are structured as profit shares.

But past account performance suggests the ~5.05% anticipated rate should materialize. Worth checking religious approvals before investing however if seeking compliance though!

HBZ Fixed Rate eDeposit

Habib Bank Zurich also offers an online-manageable fixed term account catching my eye at present with their 12 month HBZ Fixed Rate eDeposit. This bond also guarantees a solid 5.15% AER for the year timeline by locking funds, accruing interest daily.

At maturity, all returns are credited. While falling slightly below the Investec/StreamBank equivalents, topping 5% fixed for 1 year remains appealing relative to regular savings deals in my view. The £5,000 minimum deposit is higher but expected with such high headline rates.

For investors with sufficient short-term capital and no immediate cash flow needs though, it’s a yield worth seizing while still available.

LHV Bank 1 Year Fixed Term

Finally, the LHV Bank Raisin UK 1 Year Fixed Term Deposit places fifth on my list, offering a 1-year lock-in at 4% AER as of January 2024. The standout difference here is interest compounds annually rather than purely at maturity. This account can also be opened with just a £100 minimum deposit - giving it wider potential appeal by having the lowest upfront capital barriers. The drawback is significantly lower interest earned in absolute terms given the lower principal requirements.

In closing, fixed-rate bonds with 1 year tie-ups are currently providing over 4% returns, far exceeding normal liquid savings levels. The challenge is committing capital in the long term. But for non-essential funds not needed short term, these top 12-month fixed-rate bonds deserve close inspection!

Best 2 Year Fixed Rate Bonds and Savings Accounts

With stability in the economy and inflation coming down, locking savings for 2 years in exchange for elevated returns seems enticing. Based on the latest market-leading bond rates, these make my shortlist for 24-month fixed term products. We also have a detailed list of the best 2 year fixed rate bonds!

iFAST Global Bank Fixed Term Deposit

One appealing option is the new iFAST Global Bank Fixed Term Deposit, open to UK savers via Raisin, which guarantees a fixed 5.10% AER interest rate for the 2-year duration. All returns are credited upon maturity rather than incrementally.

While iFAST lacks the brand recognition of large high-street players, being backed by one of Singapore’s largest investment firms offers security in my view. For investing £10,000+ for 24 months, a yield exceeding 5% fixed remains very competitive.

This accounts for over £1,000 in total gross interest by end of the term while keeping funds largely sheltered from market dips. If willing to sacrifice access for 2 years, it’s a solid medium-term bond choice worth considering today.

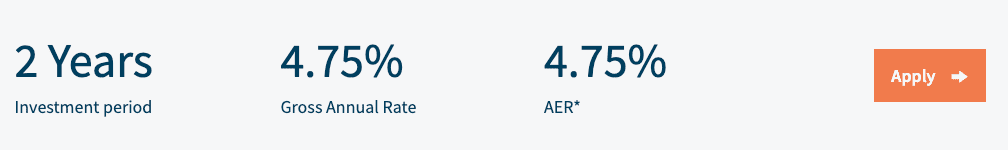

Investec Bank 2 Year Fixed Saver

Investec is again on my list as a top-tier UK issuer, Investec Bank also offers an attractive 2-year option via their Fixed Rate Saver Bond targeting the 5% AER threshold at 4.75% fixed. This account has a minimum deposit of £5,000. However, Investec’s strong brand and reputation assures while locking into above average savings returns for 2 years.

I like that interest is credited annually rather than purely at maturity, incrementally boosting gains. The flexibility to open/manage online or via dedicated managers is also a plus. For larger deposit holders seeking medium term yields exceeding typical savings rates, this Investec product deserves a look.

Zenith Bank UK 2 Year Fixed Term

For savers seeking a 2-year option from a UK-incorporated bank, Zenith Bank also has a fixed term deposit offering 4.90% AER for a 24-month lock-up. I like that interest is credited on each anniversary, giving you access to gains during the fixed period rather than having to wait until maturity like some other bonds.

The minimum deposit seems to be at £1,000. For everyday investors to be able to meet this threshold, having access to periodic interest is a differentiation factor for Zenith Bank's 2-year offer. And topped up by the fixed 4.9% AER rate, it likely beats most standard easy-access alternatives over the same timeframe.

BLME Premier Deposit Account

Finally, Islamic bank BLME notably has an advertised 2-year Premier Deposit Account with an anticipated profit rate of 4.75% AER as of early 2024. Now this return isn’t guaranteed upfront unlike traditional fixed-rate savings.

But past accounts suggest the eventual annual rate should match closely expectations. And requiring just a £1,000 minimum deposit, this short to medium-term Sharia-compliant product has wide appeal, with funds able to earn an estimated 4.75% yield over 24 months. That likely trounces typical instant access offerings.

So for investors comfortable participating in Islamic banking and seeking fixed returns under 5% with low buy-in costs, BLME’s Premier Account is very assessable.

In closing, these top picks highlight competitive fixed-rate bonds with 2 year terms that are offering just under or exceeding 5% AER at present, far outpacing normal savings returns. The trade-off is reduced liquidity and access over months. But for low risk funds not essential short term, locking up capital over a 24 month duration lets you collect yields well above most instant accounts.

Best 3-Year Fixed Rate Bonds and Savings Accounts

With 3-year bonds, investors must forfeit access for an extended period. But in return, interest rates typically exceed shorter-duration accounts. For savers with future lump sum needs more than 36 months away, locking up funds can earn substantially higher returns. These make my shortlist of top 3 year fixed rate products for 2024.

Zenith Bank UK 3-Year Fixed Term

My top pick for a 3-year option is the Zenith Bank UK Fixed Term Deposit which guarantees a competitive 4.5% AER interest rate fixed for the full 36-month duration. This account has a £1,000 minimum deposit requirement currently which is perfect for most investors.

For investors with sufficient capital reserves, that yields around £3,500 in total gross interest payments over the period. A key appeal of this Zenith account is interest is credited on each anniversary rather than just at maturity, giving you incremental access to returns.

This differs from many fixed-rate bonds delaying all interest payouts for the end. Given funds are locked for so long, getting periodic growth is a major advantage tipping me towards this 3-year leader.

BLME Premier Deposit Account

Another savings option I like for a 3-year fixed return product is the Sharia compliant Bank of London and Middle East Premier Deposit Account. Now instead of guaranteed interest, each term offers an expected profit rate - but historically these have aligned very closely with the target AER.

For the latest 36-month offering, the anticipated equivalent return is 4.5% annually over the period. Relative to top easy access accounts barely exceeding 2%, locking this rate for 3 years seems very enticing. And requiring just a £1,000 minimum initial deposit, this fixed rate Islamic banking product has very low buy-in barriers too.

Just note it pays returns upon maturity rather than throughout. But for the rate, it’s worth a close look as a good longer-term choice.

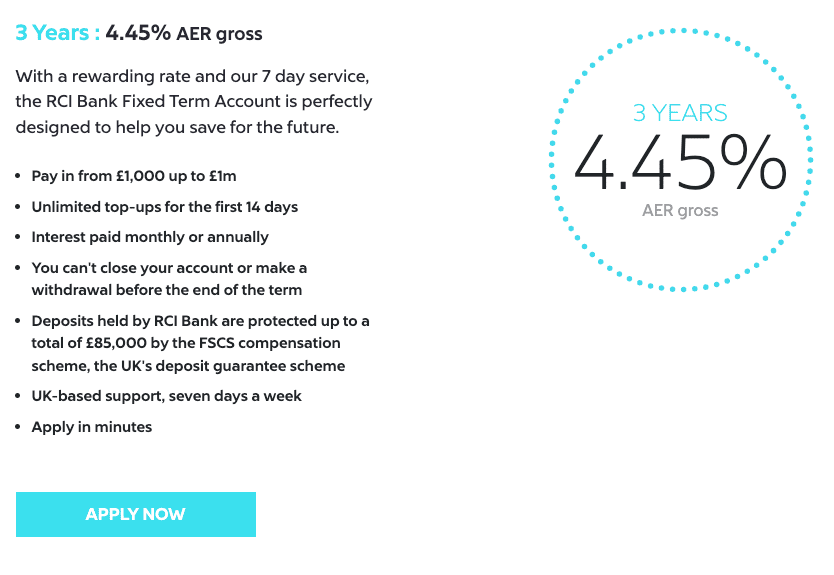

RCI Bank UK Fixed Term Account

For savers seeking a 3-year option from an established UK entity, RCI Bank UK (owned by Renault) has a fixed-term savings account option at 4.45% AER over the 36-month timeline. The minimum deposit here is £1,000.

However, interest is also credited annually on your anniversary date rather than purely at maturity and it’s an FSCS-protected account. This allows you to access returns incrementally over the period. Topping up the principal with a multi-year 4.45% rate should deliver substantially better performance than typical instant accounts over the same period. So for hands-off medium-term savings, this RCI fixed-rate bond is a contender.

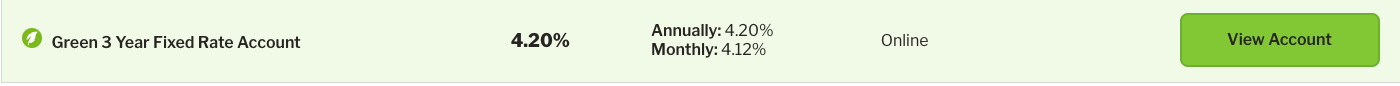

Paragon Bank Green Fixed Rate Bond

Lastly, Paragon Bank offers a unique Green 3 Year Fixed Rate Savings Account targeted towards environmentally-conscious savers. This bond offers a fixed 4.20% AER over the full term. While a slightly lower headline rate than alternatives, returns are credited annually on your anniversary dates.

I like this one particularly because you can start with only £1,000 which gets invested into Paragon’s Climate Investment Fund supporting sustainability initiatives. So this “green” spin on a 3-year UK fixed rate account makes for an appealing option for eco-friendly investors comfortable locking up capital medium term while also funding impact.

In closing, fixed-rate deals with 3-year terms are hovering around 4-4.5% yield currently - far better than normal instant access offers. The trade-off is you cannot access funds early without penalty. But for money not essential short term, locking up funds for 36 months lets you secure interest multiples above easy access. Just factor the inflexibility into any financial plans first!

Best 5-Year Fixed Rate Bonds and Savings Accounts

These types of savings accounts require sacrificing access to funds for half a decade - a major drawback. However, in return for locking money up in the longer term, interest rates tend to exceed shorter 12/24 month fixed bonds dramatically. For investors comfortable with multi-year inflexibility, securing these highest yields makes sense within a diversified savings portfolio. Based on the latest market-leading rates, these make my shortlist for top 5 year fixed rate bond options for 2024.

BLME Premier Deposit Account

Another noteworthy 5-year fixed rate product comes from BLME in the form of their Premier Deposit Account. Now instead of predefined interest, Islamic accounts provide an expected profit rate annually - but these have closely matched reality.

For their latest 60-month offering, BLME expects to deliver an equivalent 4.3% AER return on capital over the 5 years. That also handily trounces current top instant access rates. And requiring just a £1,000 minimum deposit gives this product very wide access and appeals to more UK savers not able to lock up £10k+ in other bonds. Just know returns aren’t compounded/distributed - you receive the full share upon maturity in this case. But for an estimated 4.3% yield locked over 5 years, seems extremely enticing compared to cash savings!

UBL UK 5-Year Fixed Term

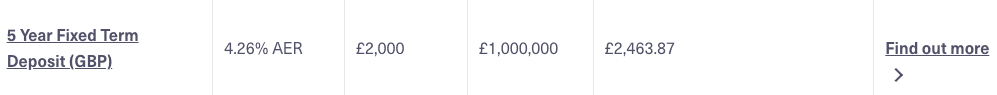

Union Bank of London (UBL UK) also has a 5 year fixed term deposit available to savers right now via Raisin, letting you lock down an interest rate of 4.26% AER for the full 60-month period. This makes for another highly competitive longer-duration savings option relative to other cash products at present.

Do note that interest compounds upon maturity here rather than any incremental annual distribution. And it requires a £2,000 minimum deposit. But in return for tying up funds 5 years lacking flexibility, you secure an inflation-beating 4.26% consistent annual return for that period. Worth strong consideration today while still on offer if you won’t need the money any time soon.

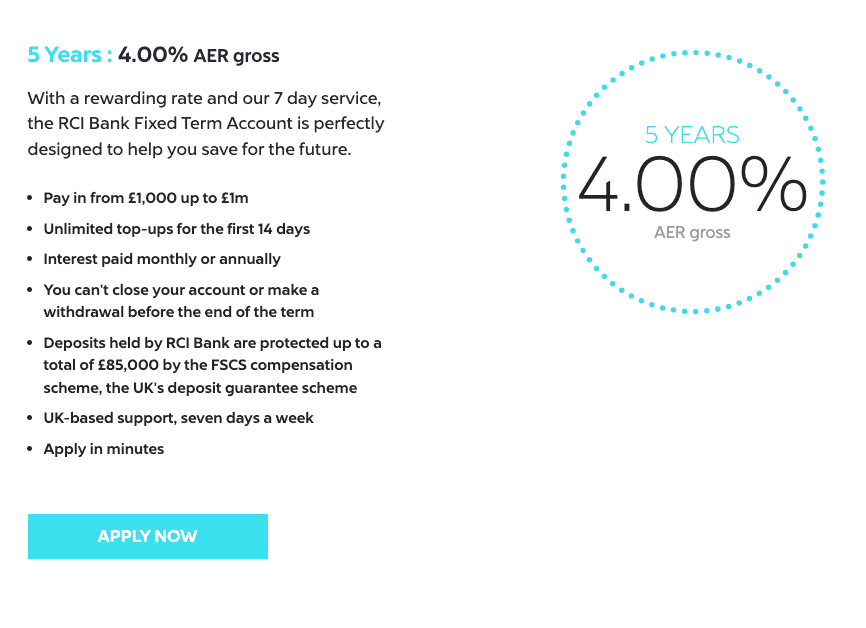

RCI Bank UK 5 Year Fixed Term

For a 5 year option offered directly by a UK bank, RCI Bank UK has a fixed-term savings account at 4% AER for a 60-month term that stands out. The minimum deposit here is set at £1,000 so it won’t meet all savers’ capacity limits.

However, interest is credited annually on your account anniversary allowing incremental access rather than full delayed payout. And with a multi-year guaranteed 4% yield, this RCI fixed-term account should deliver substantially better performance than keeping money in cash over the same period. So another leader targetting set-it-and-forget-it retirement funds.

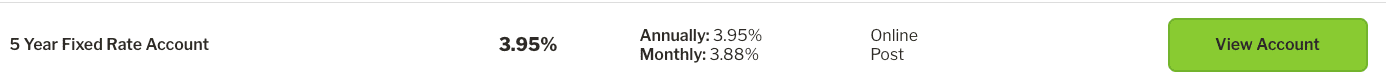

Paragon Bank 5 Year Fixed Rate

Finally, Paragon Bank’s 5-year Fixed Rate Savings Account makes my shortlist as well, offering a hair under 4% at 3.95% AER fixed all 60 months with interest distributed on each anniversary date too. This wider access account has minimum deposit limits of just £500.

So while absolute interest earned will be lower than larger balances, it allows smaller investors to lock up excess cash for an extended duration to collect steady payouts 25-50% higher than basic savings over time. Just brace for no flexibility access once deposited into this or any other fixed term bond. But in return, yields trounce shorter duration options.

In closing, these top 5-year fixed rate bonds demonstrate guaranteed returns averaging between 4-4.5% AER are very achievable right now despite recent upticks - well outpacing instant cash pots in the current environment. Just weigh up the loss of liquidity and required investment durations before transferring lump sums!

What are Fixed Rate Bonds?

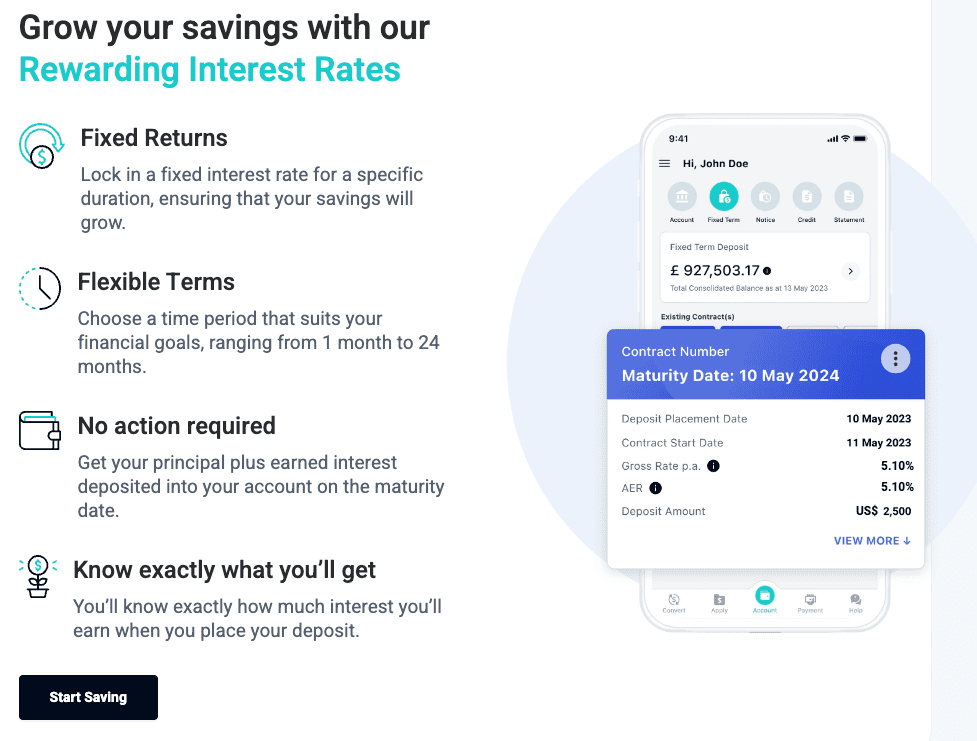

Fixed-rate bonds are a useful savings option for UK investors looking to earn interest on a lump sum over a set period of time. With these bonds, you deposit a fixed amount for a predetermined term length, ranging from 1 to 5 years typically, and in return you are guaranteed a fixed annual interest rate. This provides certainty on the returns you will achieve if you hold the bond to maturity.

Key Features

Some key features of UK fixed-rate savings bonds include:

Locked Interest Rates - The annual interest rate is locked in for the full term of the bond at the time of purchase. This gives certainty over returns.

Fixed Terms - Terms range from 1 to 5 years usually. Longer terms often have higher rates. You cannot access funds early without facing withdrawal penalties.

FSCS Protection - Bonds are FSCS protected up to £85,000 per licensed bank in the UK, providing security.

Tax Treatment - Most bond interest is taxable. It's paid gross without tax deducted. Higher rate taxpayers need to declare interest through self-assessment.

Risks and Drawbacks

While fixed savings bonds have advantages, it is also important to note potential downsides:

Lack of Access - no early withdrawals are allowed without penalties.

Interest Rate Risk - rates could rise after you lock in, leaving you stuck with a lower-paying bond.

Taxes - most interest is taxed, reducing net returns.

Opportunity Cost - tying up funds also means lost flexibility to react to other opportunities.

So its key to only invest money you won't need in the short term and to consider both current rates and where rates could move in future before committing to longer fixed rate products.

How Do Fixed Rate Bonds Work?

Fixed-rate savings bonds are essentially savings accounts that allow savers to deposit lump sums of money for predetermined periods of time at locked-in interest rates. By understanding the key features and mechanics of how these products work, UK savers can determine if fixed-rate bonds align with their financial goals.

Depositing Funds

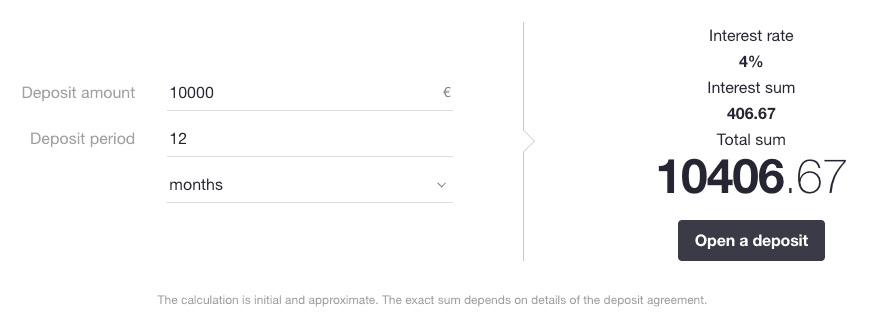

When taking out a fixed-rate bond, you'll deposit a lump sum investment amount to open the account, known as your principal. The minimum and maximum investment amounts vary by provider. This principle is then locked for the entire term length you select at the outset, typically 1, 2, 3, 4 or 5 years.

So if you put £23,000 into a 2-year fixed bond paying 2.6% AER interest, you'll earn 2.6% interest per year on that £23,000.

Locked-In Terms

A defining feature of fixed bonds is they come with set terms binding you to keep money on deposit for the duration. Terms can range from 12 months to 60 months usually.

If you try to make early withdrawals or close the account before maturity, severe early exit penalties are typically applied which erase most or all of the interest accrued. So these products suit savers who do not need access to the funds in the near future.

The advantage of agreeing to lock money away for 1-5 years is that it allows providers to offer higher guaranteed returns compared to easy access accounts.

Interest Treatment

With fixed-rate products, how the interest is calculated and paid is predefined as well. Most pay interest annually or monthly, which is compounded and added to the account balance.

The advertised AER rate factors in this compounding impact over the full term. At maturity, you'll receive your original deposit back plus all interest earned.

Do keep in mind tax implications - most interest is paid gross without any tax deducted upfront.

Early Withdrawals & Transfers

While funds cannot normally be accessed during the term without penalties, some accounts do allow deposits to be transferred to another fixed-rate product with the same provider if better rates become available.

However, recurring additional deposits during the term or partial withdrawals are generally now allowed without facing impacts. You commit to locking the full lump sum for the duration when opening the account.

So it's crucial to only deposit money you won't require access to in the short/medium term when opting for longer multi-year fixed savings deals.

Closure & Renewal

As maturity approaches, you'll receive written communication from your provider outlining options moving forward. Most bonds give you the choice of either withdrawing the full balance or renewing into a new fixed-term product.

If going the renewal route, it's important to review prevailing interest rates at the time - it may be better to switch lenders to chase higher returns rather than automatically rolling over. An advantage though is that renewed terms may not require going through full re-application processes.

Be sure to pay close attention to maturity instructions and timelines from providers to avoid unwanted account closures or renewals if intending to withdraw funds.

Protection & Risks

One appeal of fixed-rate bonds over riskier investment assets is that under FSCS rules, deposits of up to £85,000 per licensed bank in the UK receive protection. So for most savers, bond funds would be fully covered if a bank/building society failed.

That said, the value of returns may still be eroded by inflation over longer terms. So weigh up projected rising costs of living against expected interest when deciding potential terms, and factor this into financial plans.

While fixed-rate products don't carry capital risk, lack of access to funds for 1-5 years is a key consideration to factor into savings strategies before committing lump sums long-term.

Pros and Cons of Fixed Rate Bonds

Guaranteed returns over set periods allow me to lock in profitable interest rates and incrementally build my wealth over time in a low-risk manner. However, these accounts do come with defined upsides and downsides to evaluate before transferring significant capital. Based on my years investing in bonds, here are the most pivotal pros and cons I believe UK savers should factor in when assessing fixed-rate products.

Pros

Guaranteed Returns

The standout benefit fixed rate bonds offer over normal instant access savings is the ability to lock in an interest rate for 1, 2, 3, 4, or 5-year terms.This provides certainty on the exact annual return your lump sum deposit will earn over the fixed period. Whether markets swing up or down doesn’t impact the predefined AER you can expect. Certainty makes financial planning easier. And in exchange for sacrificing access, rates on fixed bonds often far exceed regular cash pots, letting you exponentially grow wealth. Just note most interest distributions come at maturity, requiring patience!

Typically Higher Interest Rates

Related to guaranteed returns, fixed savings rates will virtually always exceed standard easy access accounts targeting maximum liquidity. As an example, the top 1-year bonds today are advertising over 5% AER routinely, whereas basic savings rarely exceed 1.5%. So you dramatically boost income potential on chunks of capital not needed short term by exchanging it for a predefined higher yield over an investment timeframe matching your goals. Just recognize most fixed-rate deals do require minimum buy-in amounts between £1,000-£25,000 restricting assessability for some.

Simplicity and Predictability

I also appreciate the simplicity and predictability fixed-rate bonds offer compared to complex investment assets like stocks. You deposit an amount for a set timeline and are told the exact annual return down to the decimal. This makes projecting earnings on invested lump sums rather straightforward. There are no surprises each year over payouts allowing easier wealth forecasting and financial planning around guaranteed periodic interest accruals. Just be sure to factor the lock-in periods into any projections or liquidity needs.

Cons

Lack of Fund Access

The biggest downside to fixed rate bonds is that once you invest your lump sum for the 1-5 year duration, funds are completely locked sans access or early withdrawal flexibility. Trying to break bonds prior to maturity often incurs hefty penalties erasing your earned interest to date. So it's pivotal to only allocate cash reserves you realistically won't require for the full 1-5 year period. As emergencies can happen, keep this total illiquidity in mind.

Interest Rate Risk

Another risk around fixing returns for extended durations is that general savings rates may rise afterward, leaving you stuck earning below-market yields. Say you lock a 3.5% annual return only to then see easy access accounts jump to 4.5% a year later. You face an opportunity cost for the remainder of the fixed term. Granted over longer 5-year horizons, average rates should balance out. But it's a factor, especially on shorter 12-24 month bonds.

Inflation Risk

While fixed-rate accounts often beat savings returns, yielded interest may still fail to outpace rising inflationary costs of living. So the purchasing power and real value of your interest earnings could decline over lengthy 3-5 year bonds in particular. This erosion of returns is important to weigh against higher headline rates before committing lump sums to term deposits rather than retaining flexibility.

Overall there are defined trade-offs around liquidity, inflation, and interest rates that bond investors must factor in. But used strategically as part of a diversified cash allocation strategy, fixed-rate savings remain a valuable tool for UK investors in my experience.

How to Buy Fixed Rate Bonds

Many novice savers are unsure of how to capture the high-interest returns bonds can offer and the process can seem overly complex initially. In reality, though, buying fixed-rate bonds only takes a few straightforward steps which I'll overview here at a high level.

Determine Your Ideal Investment Term

The first decision to make is what duration of fixed rate bond aligns with your financial situation - typically options range from 6 months up to 5 full years for locking up lump sums. Consider upcoming plans where you may require access to funds over the next 1-5 years. As fixed-rate bonds severely limit access to capital during the fixed term, it's pivotal to match durations to a period where money definitely won't be needed. Have a target timeframe in mind upfront - ie.) 18 months, 3 years etc. - prior to comparing bond options.

Consider Annual, Monthly, or Cumulative Interest Treatment

Another early choice is whether you want to receive interest payments annually, monthly, quarterly, or let them compound until maturity. Receiving interest more frequently sacrifices some compound growth but does give you access to returns during the fixed period. Most fixed-rate bonds pay interest one large lump on maturity which can substantially boost overall gains long run via compounding.

Review Minimum/Maximum Investment Limits

Fixed savings also set defined minimum and maximum lump sum investment limits - typically ranging anywhere from £500 on the low end to £1 million+ for high-value customers. Have an idea of your deposit size in advance so you can screen for providers supporting those funding tiers. As limits often correlate to the headline rate offered, smaller savers may need to accept slightly lower fixed yields.

Compare Early Withdrawal Penalties

Be clear on potential early withdrawal penalties each bond charges if trying to access funds pre-maturity. These can sometimes erase your earned interest as punishment for breaking commitments. So understand the fees should an emergency force you to unlock funds before intentions.

Research Provider Credibility & Brand Stability

While major high street names like Lloyds, Barclays, NS&I, and more offer fixed rate savings, many higher-yielding bonds today come from newer challenger banks and foreign subsidiary entities seeking UK deposits. I would research the credibility, management stability, and history of any lesser-known names. For full principal protection also verify FSCS coverage limits by provider.

Leverage Savings Comparison Sites

Use free resources like Money Saving Expert, MoneyHelper, and GoCompare, as they allow easy side-by-side comparisons of fixed savings rates by factors like interest rate, minimum deposit, accessibility etc. Their tables help identify highest highest-yielding bonds from reputable names fast.

Consider Tax Implications

Understand your taxes. Most fixed-rate interest is taxable annually above personal savings allowances. Using tax-advantaged products like Cash/Stocks & Shares ISAs shelter gains from capital taxes but limit contribution amounts yearly. Buying fixed-rate bonds merely requires first analyzing personal situation, goals, and liquidity timelines before leveraging tools like comparison sites to match appropriate market-leading rates to your savings capacity and risk tolerance! Reach out with any other questions!

Advantages of Fixed Rate Bonds Over Normal Savings Accounts

The main appeal of locking money away in a fixed-rate bond over keeping cash in an instant access savings account is the ability to earn much higher rates of interest. While easy access savings rates have dropped to 0.5-1.5% in recent years, fixed-rate bonds are still offering over 2% in many cases. So you are rewarded for tying up your capita.

Other advantages include:

Useful for medium term goals where you don't need immediate access to cash

Can shelter money from market volatility and downswings

Provides diversification from equities/other risky assets

Certainty over returns can aid financial planning

So if you have cash reserves sitting idle long term, shifting some into well-paying bonds can provide a yield boost.

Who Are Fixed-Rate Bonds Suited To?

These types of savings products appeal to a range of investors, including:

Retirees/Pensioners - a means to earn interest on pension pots in a low risk way.

Conservative Investors - those wanting steady medium term returns without risk.

First Time Buyers - helping grow a deposit for a future home purchase.

Parents Saving for School Fees/University Fees - fixed returns can aid financial planning for major future costs.

Those Nearing Retirement - older pre-retirees seeking safe returns as they wind down investing timelines.

In short, fixed-rate bonds suit savers who want the certainty of returns over variable rates and are comfortable locking money away for 1-5 year periods. As there is no capital risk, they provide safer returns than investing in equities.

Government Bonds Vs Fixed Rate Bonds

Fixed-rate bonds and government bonds are both popular choices for investors, but they cater to different risk profiles and investment strategies.

Fixed-rate bonds, which can be issued by various entities including corporations and municipalities, offer a consistent interest rate throughout their term, allowing for predictable income. However, the risk associated with these bonds varies depending on the issuer, with corporate bonds typically offering higher potential returns at a greater risk.

Government bonds, on the other hand, are generally considered safer investments, especially when issued by stable governments. These bonds can have either fixed or variable rates, with many opting for fixed rates for predictability. While the returns on government bonds are usually lower, reflecting their lower risk profile, they are favored for their reliability and the security of being backed by the issuing government. In terms of market response, both types of bonds are affected by interest rate changes, but the impact is often more pronounced for fixed-rate bonds, as their value can decrease in a rising interest rate environment.

How Much Do You Need to Invest in Fixed Rate Bonds?

A question I'm often asked by friends and family new to bonds is just how much capital is required to buy in and take advantage of the higher locked-in rates they provide over normal instant access accounts. As an experienced retail bond investor, I can share insight into some of the common fixed-rate bond investment requirements worth noting for UK savers assessing these products.

Minimum Investment Thresholds

Unlike highly accessible regular savings accounts, most fixed-rate bonds do require minimum lump sum deposits to open, typically falling anywhere between £500 to £25,000+ depending on the provider. So these are tailored more towards savers with sufficient liquid capital reserves on hand rather than incremental contributors. Many of the highest 4-5%+ fixed rate accounts today want upwards of £25k lump sums. But smaller 12-24 month term bonds may only need £1,000 buy-ins. Review your price target and match it to products fitting deposit capacities.

Maximum Balance Limitations

On the flip side, fixed rate issuers also set defined maximum deposit thresholds per account, generally ranging from £250,000 up to £1,000,000 or more. So while accessible to all budget ranges on the low end, even high net worth individuals face potential caps on scale based on provider. Evaluate your total savings pool and target fixed allocation percentage before assessing rate options to confirm accounts can support your volumes.

Interest Rate Variations by Deposit Brackets

An important note is many banks offer tier fixed rate savings by deposit bracket - so accounts with minimum buys of say £25k-£100k may quote higher AERs than those taking above £100k. The more capital committed, the lower the headline rate offered in some cases. So don't assume bigger deposit capability always means better interest. Check tiering tables closely and split among multiple bonds if needed to maximize overall yield.

I hope this gives a helpful perspective on the deposit requirements associated with fixed-rate savings in the UK. While returns trounce standard cash, the trade-off is these bonds cater more towards lump sum rather than incremental savers. But used strategically and matched to your situations, fixed rates undoubtedly boost interest income potential!

Feel free to reach out to me on LinkedIn with any other questions! Always happy to talk about investing.

What are the Tax Implications of Buying Fixed Rate Bonds?

I'm also often asked about how interest earned on these fixed savings vehicles gets taxed. The specifics can confuse even seasoned investors! But in essence, the core tax impacts savers should understand fall into a few primary categories I'll summarise at a high level.

Taxation Based on Access

The main factor influencing fixed-rate bond tax treatment is your technical ability to withdraw funds during the term. If at any point you could close the account and receive interest accrued, taxation applies in the year it arises. However, most bonds restrict full access, delaying taxation until maturity when closing the account releases all gains. This leads to confusion though around annual interest reporting.

Payment & Reporting Complexities

Traditional fixed-rate bonds pay all interest upon maturity rather than incremental distribution. Yet you'll still receive annual "Statements of Interest" outlining gains technically earned each year. This falsely implies possible tax obligations before bond closure. In reality, if interest continually reinvests under locked terms, taxation only ultimately applies at maturity when finally accessible.

Personal Savings Allowance Impacts

All distributed interest does count against your £1000/£500/£0 Personal Savings Allowance based on tax bracket yearly. So even if deferring fixed rate interest tax finally hits at maturity, you must assess each prior year's gains against annual PSAs first based on statements. This complexity means fixed rate interest can unexpectedly breach allowances and trigger extra tax.

Compounding & Early Withdrawal Considerations

Because fixed rate accounts compound returns, closing earlier than intended or exceeding lengthy 3-5 year terms risks total interest exceeding Personal Savings Allowances upon withdrawal - suddenly creating a tax liability. So investors must model cumulative gains against PSAs when committing to longer-dated bonds or early withdrawals.

Legislation & Guidance

Saving vehicle interest tax rules do evolve regularly. Always reference guidance like the HMRC Manual neighboring any fixed rate applications to ensure you comply with the latest legislation and reporting timelines to avoid penalties.

While fixed-rate bonds defer declared interest for UK tax purposes instead of closed terms, understanding technical liability timing and planning for interest accumulation over time remains key to minimizing unexpected extra taxation when accounts ultimately mature.

Conclusion

In conclusion, the best fixed-rate bonds offer a compelling balance between risk and reward for investors. These bonds stand out for their ability to provide a steady and predictable stream of income, a feature particularly valuable in times of economic uncertainty. While assessing the best options, investors should consider the issuer's creditworthiness, the bond's maturity period, and how the interest rates compare to current market trends. Ultimately, the choice of a fixed-rate bond should align with the individual's investment goals, risk tolerance, and overall portfolio strategy. By carefully selecting the right fixed-rate bonds, investors can enhance the stability and diversity of their investment portfolios, securing a reliable source of income for the future.

Capital at risk. This article is for information purposes only and is not investment advice nor a recommendation. You should consider your own personal circumstances when making investment decisions. Past performance is not a reliable indicator of future performance. Tax treatment depends on your personal circumstances and rules can change.