After diving deep into the myriad of 1-year fixed-rate bonds available in the UK, I'm here to share my personal journey and findings with you.

My research wasn't just about comparing rates; it involved understanding the fine print, assessing the reliability of providers, and considering the overall investment landscape.

In the following comparison, I aim to distill my extensive research into clear, actionable insights, helping you navigate through the choices to find a bond that aligns with your financial aspirations and risk tolerance.

If you are also interested in various periods fixed-rate bonds other than 1 year like 2 year savings accounts you can also take a look to my research article about all fixed-rate bonds.

Quick List of the Best 1-Year Fixed Rate Bonds and Savings Accounts

SmartSave Bank 1 Year Fixed Rate Saver - 5.16% AER

Close Brothers 1 Year Fixed Rate Bond - 5.1% AER

Investec Bank one-year fixed bond - 5.15% AER

Bank of London and The Middle East Premier Deposit Account - 5.05% AER

RCI Bank UK – Fixed Term Savings Account - 4.6% AER

Habib Bank Zurich Fixed Rate eDeposit - 5.05% AER

Aldermore – 1 Year Fixed Rate Savings Account - 4.85% AER

Barclays 1-Year Fixed-Rate Bond - 4.65% AER

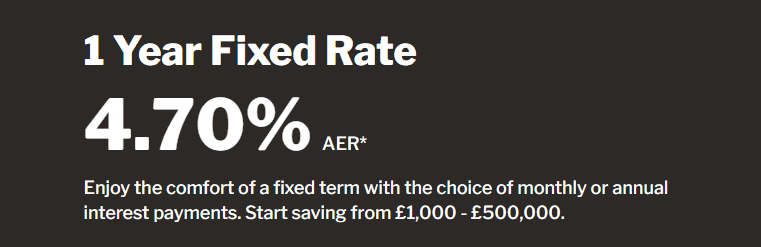

Paragon 1 Year Fixed Rate - 4.7% AER

Highest Yield 1-Year Fixed Rate Bonds

Shawbrook Bank – 1 Year Fixed Rate Bond Issue 100 - 5.12% AER

Atom Bank – 1 Year Fixed Saver - 5.10% AER

Hampshire Trust Bank – 1 Year Bond (Issue 62) - 5.10% AER

Ford Money – Fixed Saver 1 Year - 5.10% AER

Best 1-Year Fixed Rate Bonds Comparison

Bond Issuer | Minimum Deposit | Maximum Deposit | AER | Interest Payment | Open in |

|---|---|---|---|---|---|

SmartSave | £10,000 | £85,000 | 5.16% | Annually | Online, In Branch |

Close Brothers | £10,000 | £2,000,000 | 5.1% | Annually | Online, In Branch |

Investec | £5,000 | £250,000 | 5.15% | Monthly | Online, In Branch |

BLME | £1,000 | £1,000,000 | 5.05% | Annually, Monthly | Online, In Branch |

RCI | £1,000 | £1,000,000 | 4.6% | Monthly, Yearly | Online, In Branch |

RCI | £1,000 | 1,000,000 | 4.6% | Monthly, Yearly | Online, In Branch |

Habib Bank | £5,000 | £1,000,000 | 5.05% | Monthly | Online, By Phone |

Aldermore | £1,000 | £1,000,000 | 4.85% | Monthly | Online, By Phone |

Barclays | £500 | N/A | 4.65% | Monthly | Online, By Phone |

Paragon | £1,000 | £500,000 | 4.7% | Monthly | Online, By Phone |

Shawbrook | £1,000 | £2,000,000 | 5.12% | Monthly | Online, By Phone |

Atom Bank | £50 | N/A | 5.10% | Monthly | Online, By Phone |

Hampshire Trust Bank | £1 | £250,000 | 5.10% | Monthly | Online, By Phone |

Ford Money | £500 | £2,000,000 | 5% | Monthly | Online, By Phone |

Best 1 Year Fixed Rate Bonds in UK

SmartSave Bank 1 Year Fixed Rate Saver - 5.16% AER

SmartSave offers a competitive 5.16% AER. The appeal of this account lies in both its high AER and the accessible minimum deposit of just £10,000, with a maximum deposit ceiling of £85,000.

What sets SmartSave apart is not only its attractive rate but also its user-friendly online platform. In comparison to other banks on this list, SmartSave's offering is more suited for those looking for a mix of high returns and modern banking convenience. SmartSave’s reputation for customer-focused digital banking solutions adds a layer of confidence in their offerings.

Moreover, their FSCS protection ensures that your savings up to £85,000 are secure, an essential consideration for any saver. This combination of features positions SmartSave as a top choice for individuals prioritizing both yield and safety in their investment.

Close Brothers 1 Year Fixed Rate Bond - 5.1% AER

At a close second, Close Brothers (no pun intended) offers a 1 Year Fixed Rate Bond with an AER of 5.1%. This bond demands a minimum deposit of £10,000, capping at £2 million, ideal for those with a substantial sum to invest.

Despite the high minimum deposit requirement, its robust interest rate remains highly competitive. Close Brothers, known for their expertise in wealth management, further cements their reliability with this product.

When juxtaposed with SmartSave, Close Brothers targets a more affluent market, focusing on individuals or entities poised to invest larger sums. This strategy aligns perfectly with their portfolio, offering a mix of safety and attractive returns.

For investors looking for stability and decent yield in a volatile market, Close Brothers' 1 Year Fixed Rate Bond stands out as an excellent choice.

Investec Bank one-year fixed bond - 5.15% AER

Investec's one-year fixed bond stands out with an AER of 5.15%, mirroring Close Brothers in terms of annual returns.

The minimum investment threshold is set at £5,000, making it accessible to a wider audience than Close Brothers' offering but still demanding a higher initial deposit than SmartSave. It also provides a decent maximum deposit at £250,000 making great for medium sized investments.

Investec Bank, known internationally for their investment and private banking services, brings a wealth of experience and a strong reputation to the table, ensuring trust in their competitive rates and financial products.

Investec's option is especially attractive for those seeking a balance between a high return and security from a reputable bank.

Bank of London and The Middle East Premier Deposit Account - 5.05% AER

The Bank of London and The Middle East offers the 1 YearPremier Deposit Account with an expected profit rate of 5.05% AER, underpinned by Islamic banking principles.

Requiring a minimum deposit of £1,000 and accommodating up to £1 million, it caters to a wide range of depositors.

The unique aspect of this account is its Sharia-compliant structure, appealing to investors seeking ethically aligned banking practices.

Its competitive rate, combined with the ethical investment approach, positions it distinctly within the fixed rate bond landscape. Additionally, the application process is straightforward, available both online and in-branch.

This accessibility ensures a hassle-free experience for all potential depositors, further enhancing its attractiveness among the best 1 year fixed rate bonds available in today's market.

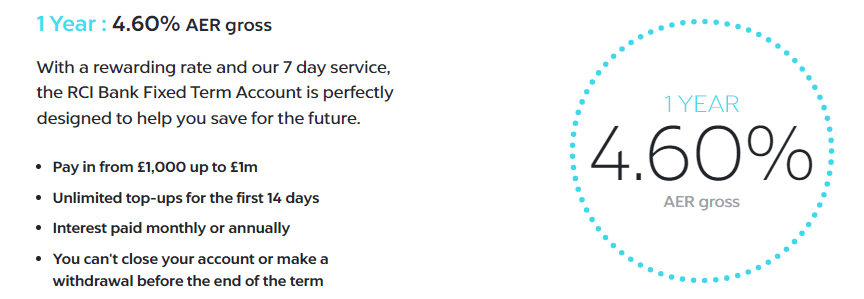

RCI Bank UK – Fixed Term Savings Account - 4.6% AER

RCI Bank UK presents a 1-Year Fixed Term Savings Account with an AER of 4,6% AER Gross.

The account is accessible with a minimum deposit of £1,000 and a cap at £1 million.

As a subsidiary of the Renault group, RCI Bank leverages its automotive giant’s heritage to offer reassurance and stability.

Compared to other offerings, it holds strong with a competitive rate and a deep-rooted backing, making it a solid choice for savers looking for the backing of a large corporate group.

However, potential savers should note that the interest is paid on maturity and requires online management.

This bond is ideal for those comfortable with digital banking and looking for a secure investment over a short term.

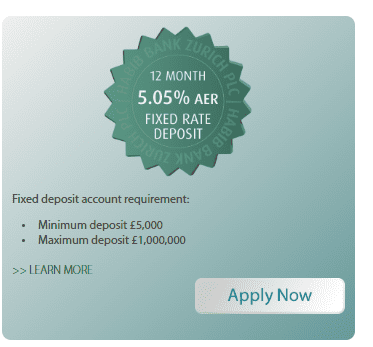

Habib Bank Zurich Fixed Rate eDeposit - 5.05% AER

Habib Bank Zurich’s eDeposit features a 1-year fixed rate of , slightly lower than the leading rates yet still competitive.

The minimum deposit sits at £5,000, targeting mid to high-tier savers.

This bond was also mentioned in our article about all fixed rate bonds as it truly features some of the best stats available in the market.

The digital-first approach of this product, coupled with HBZ’s global banking expertise, presents a pragmatic option for savers keen on digital convenience and moderate returns. To secure this rate, savers must act promptly as interest rates are subject to change.

Importantly, early withdrawals are not permitted, ensuring commitment to the term for optimal benefit.

Overall, HBZ's eDeposit stands out for those prioritizing digital accessibility and solid returns on their investment over one year.

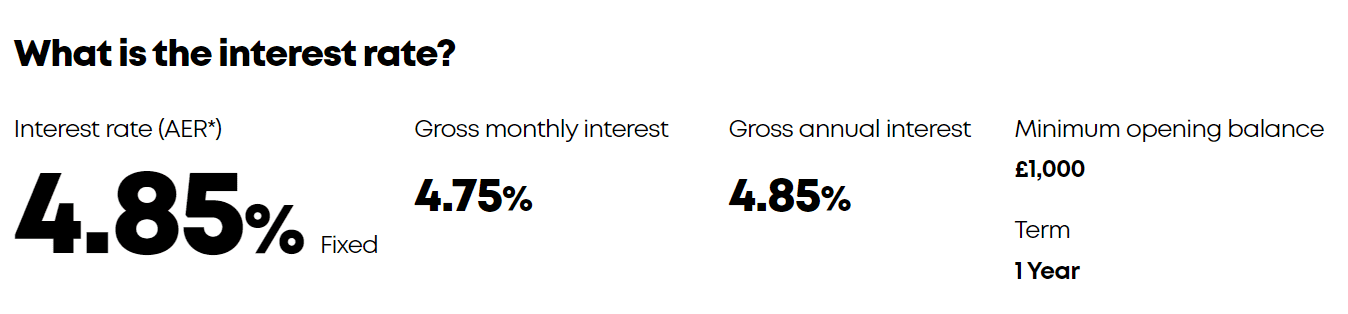

Aldermore – 1 Year Fixed Rate Savings Account - 4.85% AER

Aldermore’s 1 Year Fixed Rate Savings Account offers an AER of 4.85% and a minimum deposit requirement of £1,000.

This rate, while not the highest, is supported by Aldermore’s reputation for customer service and a straightforward online banking experience.

For those prioritising a seamless account management experience alongside competitive returns, Aldermore stands out as a strong contender.

Moreover, it's FSCS protected, ensuring your savings up to £85,000 are secure. Ideal for savers seeking both safety and a decent return on their investment over a short period.

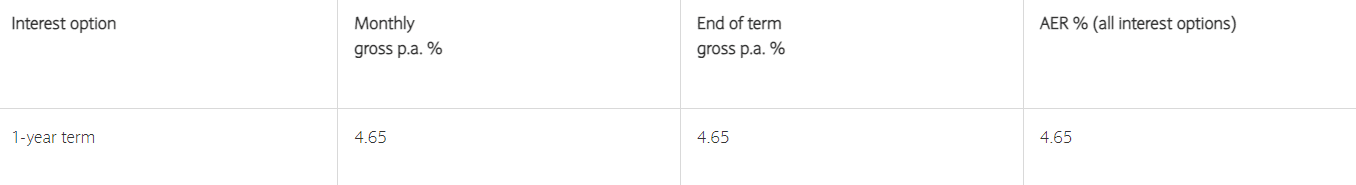

Barclays 1-Year Fixed-Rate Bond - 4.65% AER

Barclays, one of the UK’s largest and most established banks, offers a 1-Year Fixed-Rate Bond with an AER of .

The required minimum deposit is £500, arguably the most accessible on this list.

While the rate might not compete with the top performers, Barclays’ unmatched accessibility and reputation for reliability appeal to a broad audience, from first-time savers to seasoned investors.

Paragon 1 Year Fixed Rate - 4.7% AER

Finally, Paragon Bank offers a 1 Year Fixed Rate bond at , with a £1,000 minimum deposit and a maximum of £500,000.

Admittedly the AER is among lowest of the bonds discussed, Paragon's straightforward approach to savings and a solid track record in customer satisfaction maintain its attractiveness. For those looking to start with a reputable medium-sized bank, Paragon’s offering serves as an entry point into fixed-rate savings.

Additionally, it's important to add that Paragon Bank allows you to make as many deposits for the first 28 days of your application request making a more agile option in case you change your mind for your investment.

Other High Yield 1-year Fixed Rate Bonds

Shawbrook Bank – 1 Year Fixed Rate Bond Issue 100 - 5.12% AER

Shawbrook Bank’s 1 Year Fixed Rate Bond Issue 100 caught my attention with its competitive perks.

The minimum deposit sits neatly at £1,000, which I find quite accessible for most savers looking to secure their funds while the maximum is at £2,000,000.

What's more interesting is the annual interest rate and AER both stand at a promising 5.12%.

Comparing it to others, Shawbrook Bank offers an excellent balance between the required deposit and returns.

Additionally, Shawbrook holds a strong reputation for customer-centric banking solutions, enhancing my confidence in recommending this bond.

It's an ideal choice if you're after stability and a reputable issuer without needing a hefty deposit.

For those seeking a secure investment with the highest returns, Shawbrook's 1 Year Fixed Rate Bond Issue 100 emerges as a top contender.

Atom Bank – 1 Year Fixed Saver - 5.10% AER

Atom Bank’s 1 Year Fixed Saver is something of a game-changer, with a 5.10% AER its digital-first approach simplifying the process significantly.

The minimum deposit here is £50, making it incredibly accommodating for savers of all capacities. The annual interest rate and AER are both appealing , which, when compared to others, positions Atom Bank favourably for those seeking higher interests with low upfront investment.

Atom Bank’s reputation as an innovative and customer-friendly digital bank adds to the appeal, making it a standout choice for tech-savvy savers looking for competitive rates and convenience.

Additionally, its mobile app enhances user experience with easy account management and real-time updates, ensuring savers are always informed about their investments.

This level of accessibility and efficiency is why Atom Bank's offering leads in the 1 year fixed rate bond market.

Hampshire Trust Bank – 1 Year Bond (Issue 62) - 5.10% AER

Hampshire Trust Bank steps up with its 1 Year Bond (Issue 62) offering a robust annual interest and AER of 5.10%.

The minimum deposit required is £1, which is an unmatched entry point but still maintains high yields.

This positions Hampshire Trust Bank as an enticing option for savers willing to invest a bit more for a better yield.

The bank’s solid reputation in providing reliable savings solutions complements this offer, making it a compelling option for savers focused on balancing a moderate initial deposit with attractive returns.

Moreover, the bond's fixed rate ensures savers know exactly what returns to expect, providing a sense of financial security and planning ease. With no fees for opening the account and the backing of the Financial Services Compensation Scheme up to £85,000, it's a safe and straightforward way for individuals to grow their savings over a year.

Ford Money – Fixed Saver 1 Year - 5% AER

Lastly, Ford Money’s Fixed Saver 1 Year presents itself as another strong contender.

The minimum deposit is remarkably low at just £500, making it the most accessible amongst those reviewed.

The bond offers an annual interest rate and AER of 5%, slightly lower than others but still advantageous for those with smaller sums to invest.

The bond’s capacity to hold a maximum balance of £2,000,000 (excluding interest), makes it also great for larger investments.

The product allows for unlimited deposits within the first 21 days of account opening, providing flexibility to adjust investments early on.

It also features a Best Rate Guarantee, ensuring savers receive the most competitive interest rate available.

A 14-day cooling-off period is provided for added peace of mind, allowing decisions to be reversed if necessary.

Interest earned can be paid out monthly or yearly, based on the saver’s preference. Furthermore, the option to open multiple accounts, including joint accounts, makes it a versatile choice for managing both individual and shared financial goals.

Ford Money’s reputation for straightforward and customer-friendly financial solutions further ensures savers are making a wise choice.

Its lower yield is balanced by the lower barrier to entry, making it ideal for first-time savers or those looking to dip their toes into fixed-rate bonds.

In conclusion, when selecting a 1-year fixed-rate bond, it's essential to consider not just the interest rates but also the minimum deposit required and the provider's reliability. Ford Money exemplifies this balance, offering an accessible entry point with competitive returns for new savers.

What is a 1 Year Fixed Rate Savings Bond?

A 1-year fixed-rate bond is a type of investment where you lend money to the issuer (which can be a government, municipality, or corporation) for a fixed period of one year.

In return, the issuer agrees to pay you a predetermined rate of interest at regular intervals (usually annually or semi-annually) during the term of the bond. At the end of the one-year period, the issuer is obligated to repay the principal amount you originally invested.

The "fixed-rate" aspect means that the interest rate you receive does not change throughout the life of the bond, regardless of fluctuations in market interest rates. This makes fixed-rate bonds a stable and predictable investment, as you know exactly how much interest you will earn and when you will receive it.

Investors often consider 1-year fixed-rate bonds when they are looking for a relatively short-term investment that offers more stability and predictability than stocks or variable-rate bonds.

However, because the term is short and interest rates for such bonds are usually lower than for longer-term bonds, the returns may be modest compared to other investment options.

Fixed-rate bonds are considered a conservative investment choice, suitable for risk-averse investors or those looking for a safe place to park their money for a short period.

The appeal of a 1-year fixed rate bond lies in its simplicity and the predictability of returns.

For example, Shawbrook Bank offers a bond with a minimum deposit of £1,000 and an AER of 5.12%.

In comparison, Atom Bank provides a more accessible option with a minimum deposit of £50 and an AER of 5.10%, catering to those with smaller savings wanting to maximise their interest.

What makes each option stand out is not just the raw numbers but the background of the issuer.

Reputation plays a crucial role in the decision-making process, reassuring me that my investment is secure. Each bank brings its level of stability and customer service dedication to the table, influencing where I decide to place my trust and my money.

Of course, there's more to each bond than just these figures. The terms and conditions, such as early withdrawal penalties and how interest is paid out, are vital considerations. Each provider has its method – some compound interest annually, others at maturity, affecting the overall return on my investment.

Are Fixed Rate Bonds Safe?

When exploring the safety of fixed rate bonds, it's crucial to dive into what they offer. These financial instruments are renowned for their security and consistency. By opting for a 1-year fixed rate bond, you’re essentially locking your money away at a predetermined interest rate. This is quite appealing as it shields you from fluctuations in the broader market interest rates.

The Annual Equivalent Rate (AER) effectively represents the interest I can earn on my savings over a year, assuming I leave the money untouched. For example, with a minimum deposit of £1,000, a 1-year fixed rate bond from the issuers I've examined guarantees a return detailed in their terms.

Reputation should play a significant role in your decision. All these institutions are regulated by the Financial Conduct Authority (FCA), which adds an extra layer of security to your investment. In terms of access, some bonds do allow for early withdrawal, but it's important to note the 180-day loss of interest penalty. This might influence the overall attractiveness of the bond, depending on your financial flexibility.

However if safety is your number one concern you should also consider investing in Government Bonds as these are issued by the UK government and are considered the most safe investing option when it comes to bond investing.

In terms of safety and reputation, it's a balancing act. While higher rates are enticing, the stability and reliability of the issuer, coupled with FCA regulation, reassures of the safety of your investment.

On the other hand if returns is your primary goal and you are willing to take greater risks you should also consider corporate bonds.

Corporate bonds and fixed-rate bonds often intersect in the investment landscape, offering investors a blend of potential higher returns and predictable income.

While corporate bonds, issued by companies, might carry a higher risk compared to government securities, they often come with higher interest rates, similar to fixed-rate bonds, which lock in a consistent return over their term.

This makes them an attractive option for those looking to diversify their portfolio with assets that provide a steady income stream while navigating the risk-reward spectrum thoughtfully.

How to Buy 1 Year Fixed Rate Bonds

When considering a 1-year fixed rate bond, knowing the ins and outs of how to purchase one is crucial for making informed decisions.

I've found that the initial step is selecting the right financial institution.

The application process can vary widely, but generally, it involves opening an account online, over the phone, or in some cases, by visiting a branch in person.

Online applications tend to be the most convenient, allowing you to set up everything from the comfort of home. Essential details you'll need to provide include personal identification, proof of address, and of course, your initial deposit.

Speaking of deposits, the requirements can differ. Usually, a minimum deposit is around £500, but it's always best to check as some issuers might require more. Understand the limits of how much you can invest since some bonds might cap the maximum deposit. And don't forget about the Annual Equivalent Rate (AER), which gives you a clear picture of what you can expect in terms of earnings over the year.

Research is your best friend in this journey. Comparing AERs, the convenience of account management, and the flexibility regarding access to your funds, including penalties for early withdrawal, are all factors I closely scrutinize.

While 1-year fixed rate bonds offer less liquidity, I'm drawn to the certainty they provide, particularly in an unpredictable market. They're an excellent way to ensure a fixed return on your savings, especially when keeping an eye out for competitive rates and terms that best suit your financial goals.

Wrap Up

It's important to remember that while these bonds present an appealing opportunity for guaranteed returns, the choice of where to invest should be guided by individual financial goals, risk tolerance, and the broader economic context.

With interest rates subject to change based on national and global economic shifts, staying informed and adaptable is key.

In case you have any questions about fixed rate bonds or you would like to suggest an addition I am always reachable through LinkedIn and email (george@wealthyhood.com) so feel free to drop me a message. I am always happy to discuss anything related to investing or the economy.

F.A.Q.s

What are 1-year fixed rate savings bonds?

1-year fixed rate savings bonds are investment instruments where you lock away your money for a year at a fixed interest rate, guaranteeing a consistent return on your investment.

Who offers the best 1-year fixed rate bonds?

Options like Shawbrook Bank, Atom Bank, Smartsave, Close Brothers, Barclays and Hampshire Trust Bank are among the top providers, offering competitive interest rates and varying minimum deposit requirements. It's essential to compare different factors alongside each bank's reputation and customer service.

What is the Annual Equivalent Rate (AER)?

The Annual Equivalent Rate (AER) is a standard interest rate that allows you to compare the annual interest earned on savings across different financial institutions, ensuring you make an informed decision.

How safe are 1-year fixed rate savings bonds?

These bonds are generally safe as they're regulated by the Financial Conduct Authority (FCA) in the UK, offering a stable return. However, it's crucial to choose bonds from reputable providers to ensure the security of your investment.

Can I withdraw my money early from a 1-year fixed rate bond?

Yes, early withdrawal is usually possible but comes with a penalty, which varies between financial institutions. It's important to consider the terms regarding early withdrawal before investing.

How do I choose the right 1-year fixed-rate bond?

Selecting the right bond involves researching different banks' Annual Equivalent Rates (AER), minimum deposit requirements, account management convenience, and access to funds. Always consider your financial situation and investment goals.

Why is customer service important when choosing a fixed rate bond?

Good customer service ensures a smooth investment process, convenient account management, and effective communication, enhancing the overall experience with the financial institution.

Capital at risk. This article is for information purposes only and is not investment advice nor a recommendation. You should consider your own personal circumstances when making investment decisions. Past performance is not a reliable indicator of future performance. Tax treatment depends on your personal circumstances and rules can change.